Private Equity vs Venture Capital: Understanding the Distinctions

Private Equity (PE) and Venture Capital (VC) are often used interchangeably, however, they are very different entities. PE refers to investing mainly in already established companies while VC focuses on funding startups. Both have different objectives and strategies behind their investments, making it important for entrepreneurs and investors to understand the distinctions between them.

This article will define both private equity and venture capital, explain key differences and similarities between the two, as well as outline factors that can help determine which is most suitable for a given situation.

By exploring these topics currently being implemented by leading firms around the world, market participants armed with knowledge from this article will gain sufficient insight into making successful investment decisions to ultimately reach their financial objectives.

Contents

- Private Equity (PE)

- Venture Capital (VC)

- Conclusion

Private Equity (PE)

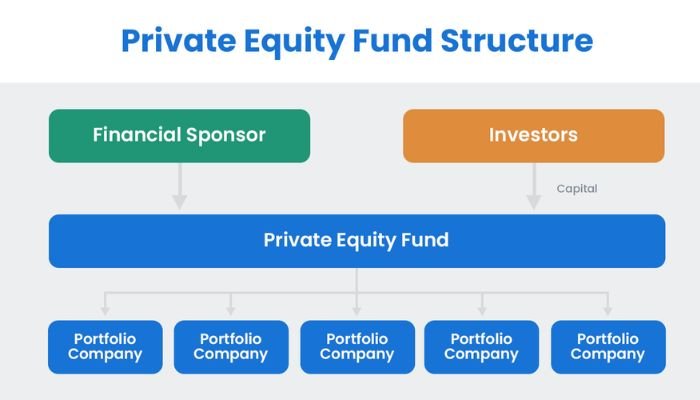

Private Equity (PE) is a form of financial investment focused on investing in companies at various stages of the business cycle. It encompasses venture capital, distress and arbitrage, leveraged buyouts/recapitalizations, and mezzanine debt financing with returns typically derived from capital gains realized through refinancing or exit events.

Private Equity funds often employ attorneys, and accountants specialists to conduct due diligence for fund investments and asset investments further ensuring that prior agreement terms are adhered to when applicable. PE can be private as well as public entities that display gains that will benefit other shareholders apart from the investors themselves.

Characteristics of Private Equity Investments

1. Types of companies targeted

Private Equity investments target established companies that have already achieved a certain level of operating proficiency.

High-growth industries and larger firms are typically favored in PE deals as they tend to be associated with better returns. Additionally, the capital is used by management to form new corporate entities or to purchase controlling interests in existing entities through leveraged buyouts and recapitalizations.

Typically, those firms targeted must show an attractive earnings outlook for investors while exhibiting enough liquidity for repayment of investors’ capital should the need arise.

2. Investment stages

Private equity investments typically target mature companies requiring expansion capital and are characterized by their three distinct stages: early-stage (seed or startup), mid-stage (growth), and late-stage (mature).

PE invests mainly in large, established businesses. Early-stage investments can range from building out a digital platform to launching an innovation outside of the original business model or taking an underperforming company private.

In mid-stages, PE firms take on riskier investments in order to rapidly grow the value of a company network either by scaling operations, entering new markets, making acquisitions, or expanding geographically. Finally, late-stage investments provide buyout capital for mature portfolio companies looking to grow with minimal incremental funds required.

3. Investment size

Private Equity investments typically involve larger transaction sizes and business opportunities than Venture Capital investments.

The minimum size of Private Equity transactions can range from tens to hundreds of millions depending on the firms’ strategy, purchase price, industry growth rate, and capital structure.

The successful completion of a PE investment depends on initial and continuing commitment to significant levels of capital over the life of the transaction. PE Investment rounds usually come in installments set at intervals determined during due diligence rather than as one lump sum at once.

Role of Private Equity Firms

1. Acquisitions and leveraged buyouts

Private Equity Firms specialize in providing capital for acquisitions and leveraged buyouts (LBOs). By conducting investments through LBOs, PE firms can create value for their portfolio companies while avoiding systemically risky forms of debt financing such as junk bonds.

Through these transactions, the investment firm purchases a target company which is then reorganized in pursuit of higher profits. It does this by temporarily creating more debt on its balance sheet, “levering” it against numerous assets.

This emerging business usually needs further growth to cover the interest payments before being sold or refinanced into equity markets – making exit strategies the conclusion part of business success within the strategic world of Private Equity investments.

2. Value creation and operational improvements

Private Equity firms are generally responsible for adding value and making operational improvements in the companies that they invest in.

The return of investment, growth, and exit are all crucial factors that will determine the success rate of a specific company so private equity teams take great care to help maximize these key aspects throughout a company’s operations.

This is accomplished through rigorous cost-cutting measures, improving visibility into markets or customers, addressing key organizational issues, and providing valuable strategic guidance. Ultimately, Private Equity firms exist to leverage their experience and expertise to increase economic gains by helping create a clear roadmap and strategy for their portfolio companies toward long-term sustainability.

Investment Lifecycle in Private Equity

1. Fundraising

The private equity fundraising process is a critical stage of an investment lifecycle. A PE firm must build relationships with investors, identify opportunities, and secure capital commitments for each fund’s formation.

To achieve success, a PE firm needs to strategically outline the goals and limitations of its new fund while leveraging the latest industry developments as well as the credibility earned from previous successful investments. Fundraising activities should prominently emphasize value-add strategies in presenting corporate insight, attractive sector-based advice, and proven performance successes that will result in high returns for investors.

2. Deal sourcing and due diligence

Deal sourcing and due diligence are two of the stages in the private equity investment lifecycle. Private equity firms have, or employ a network of contacts to assess potential deals that fit with their investment criteria.

Once a deal is identified, an intensive due diligence process determines whether the target company’s business model satisfies its risk/reward tolerances for this type of transaction. As part of this task, professionals related to accounting, tax advice, and legal guidance help PE with essential information in order to verify the quality and feasibility of an investment opportunity such as market forecasts, ownership history, and exit strategies.

3. Deal execution and portfolio management

Private equity firms invest in companies to create value through operational improvement and acquisitions. Deal execution is a critical step in the private equity investment lifecycle whereby specific structures are defined that entitle investors to returns within pre-defined parameters upon successful exit.

The portfolio management stage follows this step, during which private equity sponsors work alongside company executives to affect the performance improvements necessary for an eventual exit.

Key activities at this stage of private equity investments include recruiting new members of executive staff, sharpening strategy focus, and utilizing contacts from the PE firm’s network for onboarding mergers or acquisitions with other businesses as part of its due diligence process.

4. Exit strategies

Exit strategies in private equity involve the sale of portfolio companies to up their value for investors. strategic buyers or financial sponsors, as well as listing them on exchanges via IPOs are some of the most popular exit techniques used today.

Exits generally occur between 4-7 years since the initial investment is made and have an objective of maximizing returns for investors. Each specific industry may have its own favored type of exit strategy; however, capital preservation, capital appreciation, and liquidation distributions are generally evaluated before moving forward with any particular valuation technique. The chosen exit approach must ensure alignment with not only equity holders’ interests but also debt holders.

Venture Capital (VC)

Venture Capital (VC) is a type of financing provided by investors to start-up companies and small businesses that have long-term growth potential. Typically, venture capitalists are looking for novel ideas with high expected returns on their investments and provide entrepreneurs with the financial resources needed to launch new products or services.

VC typically takes place after seed funding and all types of venture capital provide guidance in order to maximize portfolio performance as well as aid in helping influencers network early-stage companies. Investments range from mere hundreds to millions of dollars, depending on the type of VC being offered. In exchange, investors receive an equity stake in the company they finance.

Characteristics of Venture Capital Investments

1. Types of companies targeted

In the venture capital space, the types of companies that receive support mainly include startups in high-growth markets. VC aims to identify and fund young companies with the potential for abnormally high returns.

Typically, they also prefer businesses that operate digitally, and are economically viable and disruptive to their market or industry; changes to the status quo offer sustained long-term competitive advantage.

Often, these have established some early traction which gives investors more confidence in the investment decision as well as better access to additional financial resources down the line.

2. Investment stages

Venture Capital investments target start-ups and small businesses with high potential for growth.

Categorized based on the company’s development stage, the typical investment consists of Seed funding in early concepts or prototypes; Series A/B/C continuing financing for expanding companies; bridge rounds for additional capital to optimize product and sales channels; and follow-on rounds sometime after the initial launch to support continued operations.

VCs specialize in identifying innovative technologies, disruptive products, significant market opportunities, and large scalability by acting as an intermediary between startups/companies seeking risk capital and investors who look for profitable investment options in financial markets.

3. Investment size

Venture Capital investments range in size depending on the company’s investment stage and growth prospects.

The initial Venture Capital, also known as seed funding, is typically smaller when companies are just starting out or have not yet released a product to market.

As a company progresses further through its life cycle additional financing rounds will require larger sums of capital to grow operations and scale.

Role of Venture Capital Firms

1. Early-stage funding and risk-taking

Venture Capital Firms provide an opportunity for high-growth, yet early-stage investments that require a level of risk-taking that would not normally be taken by traditional investors.

Unlike private equity firms, VCs generally disperse smaller amounts of capital to earlier businesses in more development phases – sometimes being considered as almost seeds planted on the investor’s behalf.

Additionally, a VC plays another important role such as providing mentorship and guidance valuable to help promise companies succeed down their paths of innovation.

2. Mentorship and guidance

Venture Capital Firms (VC’s) play an important role in fostering businesses and entrepreneurs with their long-term financial investment and more importantly, mentorship. Aside from attracting experienced venture capitalists in the field, startup companies gain various support services that are beneficial for further growth.

Such support comprises financially related assistance such as goal setting, cash projections as well as business planning structure. Above all VC firms contribute significantly to advice on the strategy for a rapid expansion or exit path if needed—an essential element sufficient to make informed decisions at critical stages while growing its potential.

Not only do these professionals have relevant networks bulged alongside tangible insights but also provide informative feedback derived from their previous entrepreneurial endeavors to guide novice tech founders.

Investment Lifecycle in Venture Capital

1. Fundraising

Venture capital fundraising involves identifying potential investors who will invest in the venture capital fund. This includes connecting with private and institutional investors, such as pension plans, foundations, endowments, and family offices.

It is also important for the venture capitalists to build relationships with these prospective investors at early stages to ensure their commitment through periodic offering rounds that would enable advancing critical activities as those deals progress.

Venture capital firms rely on existing investors to provide information regarding the management structure of the fund which could help attract new ones seeking a profitable return over long-term investment terms of 5-7 years.

2. Deal sourcing and evaluation

Deal sourcing and evaluation is the process of finding entrepreneurs first—and analyzing their potential value later.

The VC firm’s team will develop sources for deals, perform initial filtering based on specific criteria, build detailed in-person profiles about founders and teams to get to know them better, carry out statistical analysis using sophisticated software systems, network with other industry professionals to gain insights when needed, follow venture capital trends carefully for new opportunities.

In essence, it requires a large focus on research and leveraging external data sources combined with a greater understanding of the startup landscape made by seasoned decision-makers at the firm.

3. Term sheet negotiation and due diligence

The venture capital (VC) investment lifecycle involves a number of discrete activities. One key activity is term sheet negotiation, wherein VCs and business investors negotiate terms for a possible investment.

Following this is due diligence, analyzing various factors such as financials, technology development plans, competitive landscape analysis, customer research, and other related considerations in order to assess the investment opportunity’s feasibility.

Should all go well during due diligence, actual investments may take place depending on conditions stipulated in the term sheet negotiations before.

4. Post-investment involvement and support

Post-investment involvement is an essential component of venture capital investment lifecycles, as venture capital firms offer necessary guidance to enable startup success.

After a VC firm signs the term sheet with the invested company, they help to build relationships that can drive strategies and crucial decisions that move the businesses forward.

By offering advice centered around such matters as personnel selections, corporate reorganization, and strategy development, a post-investment degree of commitment from both parties can result in more favorable home runs for all involved stakeholders.

This ongoing level of support also helps successful companies gain even greater access to resources and potential exits down the line.

5. Exit strategies

Exit strategies in venture capital refer to the various options an investor or firm has for closing a VC deal.

These may include IPO, M&A, sale of shares back to the company, liquidation of assets, and distributions back to the investors from profits earned. Successful exits require wise decision-making when it comes to timing and structures; successful exits are lucrative for all involved parties as they meaningfully contribute upwards returns on investments.

Secure exit strategies support focused growth and allow investors opportunities to return sizable profits.

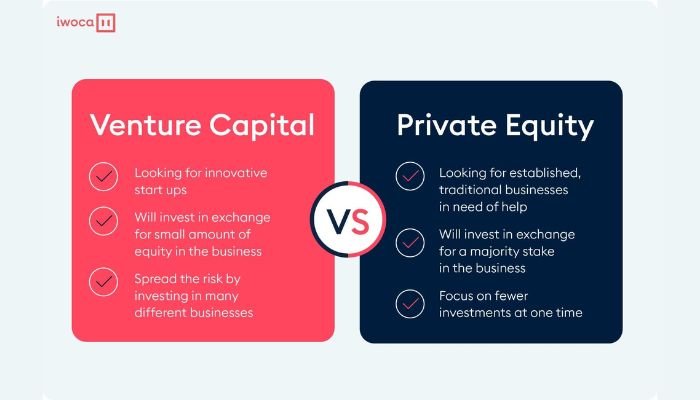

Key Differences between Private Equity and Venture Capital

Investment Focus

Private Equity (PE) is traditionally focused on larger, more established, and mature companies. These firms usually invest in takeovers or majority stakes of existing enterprises to create value primarily through increased financial leverage or enhanced operations.

On the other hand, Venture Capital (VC) investors typically offer capital investments to start-ups or early-stage enterprises which usually have business models with high growth potential built into their plans.

VCs focus chiefly on indirect non-operational guidance, assessing a business’s potential for success by taking calculated risks versus seeking instant rewards that can be seen in PE deals/buys.

Investment Size

Private Equity (PE) investments involve a higher sum of money and can range from $25 million to hundreds of millions.

On the other hand, Venture Capital (VC) investments involve much smaller amounts and go up to several million dollars.

The investment size plays a significant role in influencing the returns obtained from such ventures as venture capital is inherently associated with high-risk appetite and thus requires careful selection that certainly extends further than just investing amounts; however, one should keep in mind that private equity tends to polish those robust projects continuously before providing returns on a broader scale.

Investment Stages

Private equity and venture capital represent two different types of investments with distinct characteristics.

One key difference lies in the investment stages that are targeted when making these investments: private equity typically makes longer-term, buyout deals for a majority stake position in often more mature companies while venture capital focuses on startups or other fast-growth business cases needing seed funding.

Private equity also targets reinvestment opportunities to put their funds to use quickly and grow over time into larger companies. Venture capital, however, seeks higher returns efficiently via companies projected for rapid growth potential.

Risk and Return Profiles

The risk and return profiles of Private Equity (PE) and Venture Capital (VC) investments vary greatly. PE investments generally involve less risk, because they are typically in established companies that generate stable returns.

Investing in a mature company tends to be low-risk but also provides lower potential returns as compared to taking larger risks on early-stage startups by venture capitalists. VCs accept higher uncertainty in exchange for potentially high returns which may manifest over a longer timeline.

Investor-specific goals should inform their decision when deciding between PE vs VC investment types, including the level of risk they can bear and their desired return rate.

Time Horizon

Time horizon is one of the key differences between private equity (PE) and venture capital (VC). PE firms typically have a longer-term focus, often looking to hold investments for five years or more.

Thus, profits come over the long-term as performance is measured against indicators like return on capital employed over multi-year periods.

VCs, on the other hand, usually take a shorter-term view due to early-stage investments in startups and large expectations of high returns. Consequently, success from venture investments tends to be accelerated compared to PE investments where profits may be seen many years down the track.

Ownership and Control

One of the major distinctions between private equity and venture capital is in regard to ownership and control.

Private equity firms typically maintain majority ownership of a company after investment, giving them more control over operating decisions. Venture capitalists, on the other hand, are often minority shareholders who play a less active role in day-to-day operating matters.

Private Equity funds look for companies that they can influence through active board representation and later sell or launch publically once improvements boost their valuations; whereas Venture Capital funds usually have an exit strategy based on securing listing on stock exchanges at pre-arranged appreciations in value to realize returns from such investments.

Exit Strategies

The key difference between private equity and venture capital exit strategies says a lot about the level of risk associated with either. In Private Equity, the dominant strategy is an eventual sale of the entire portfolio company or liquidation to achieve cash return on investment and exit.

Whereas, in Venture Capital, typically involves IPOs, secondary investments, or outright sale of a portion or all stakes when higher returns can be achieved due to growing values in companies within setup deals.

This makes it generally low-risk for VCs who build value without putting pressure on investors by not necessarily needing to fully liquidate initial invested amounts plus profits—or be forced into timing divestments even at insufficient return expectations.

Conclusion

Private equity (PE) and venture capital (VC) have differences in their approach to investments across many factors such as focus, size, stage of investment, ownership control, and exit strategies.

Understanding the distinction between these two types of investors can help entrepreneurs develop more tailored strategies on how best to maximize funding for their businesses. In addition for those interested in investing in a project or company understanding the risk and return dynamics that different PE/VC approaches provide is also important when considering which opportunity optimizes performance potential for an investor.

Aligning investment goals and capital with management objectives will allow the operations team to create long-term sustainable solutions that are well supported by external conversations and financing.

Regardless of the investment approach needed, both PE/VC offers important considerations vulnerable businesses can utilize to maximize value during their investment goals.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.