Growth Equity vs. Private Equity: How Growth Equity Works

Growth equity is a form of private equity investment that concentrates on offering financial resources to enterprises that are in the process of expanding. The investment strategy in question has gained significant popularity due to its potential for generating higher returns compared to conventional asset classes such as bonds and stocks. Firms that allocate resources towards growth equity are generally past the initial phase of establishment and are generating revenue, yet they still require funding to support their expansion strategies. Enterprises pursuing growth equity typically possess a well-defined trajectory towards profitability and are pursuing capital infusion to expand their business operations, reach novel markets through product innovation, and explore fresh strategic initiatives.

Contents

Enterprises in search of growth capital are generally established entities with an established and adaptable business model with minimal institutional capital. These entities are recognized for producing revenue growth in the double digits and are frequently handled by a proficient management team that possesses a well-defined outlook for the organization’s prospects. Furthermore, these corporations might possess distinctive competitive advantages, a vast target market, or an exceedingly distinguished commodity or service. Growth equity investors typically pursue notable minority stakes, typically ranging from 15-30%, and exhibit a preference for a holding duration of 3-5 years. Investors also exhibit a preference for investments that offer downside protection and prioritize preferred shares. Additionally, they tend to rely on management input as a key factor in their investment decision-making process.

Private Equity vs. Growth Equity: What’s the Difference?

The term “private equity” has been commonly used to denote a variety of private investments, that include a spectrum of investment strategies from venture capital to private capital buyouts. Although growth equity and private equity share the characteristic of being private investments, they exhibit distinct dissimilarities. Regarding the maturity of a company, growth equity investments are typically aimed at companies that have already demonstrated their business model and are generating revenue. Conversely, private equity investments may be directed toward companies at different stages of maturity. Private equity transactions usually involve higher ownership stakes since these firms frequently aim to acquire controlling interests in their portfolio companies. Debt levels can also be higher in private equity deals, as these firms may use leverage to finance their investments. Growth equity investors may experience a lower level of control over the company in contrast to private equity investors, who frequently adopt a more hands-on approach to management.

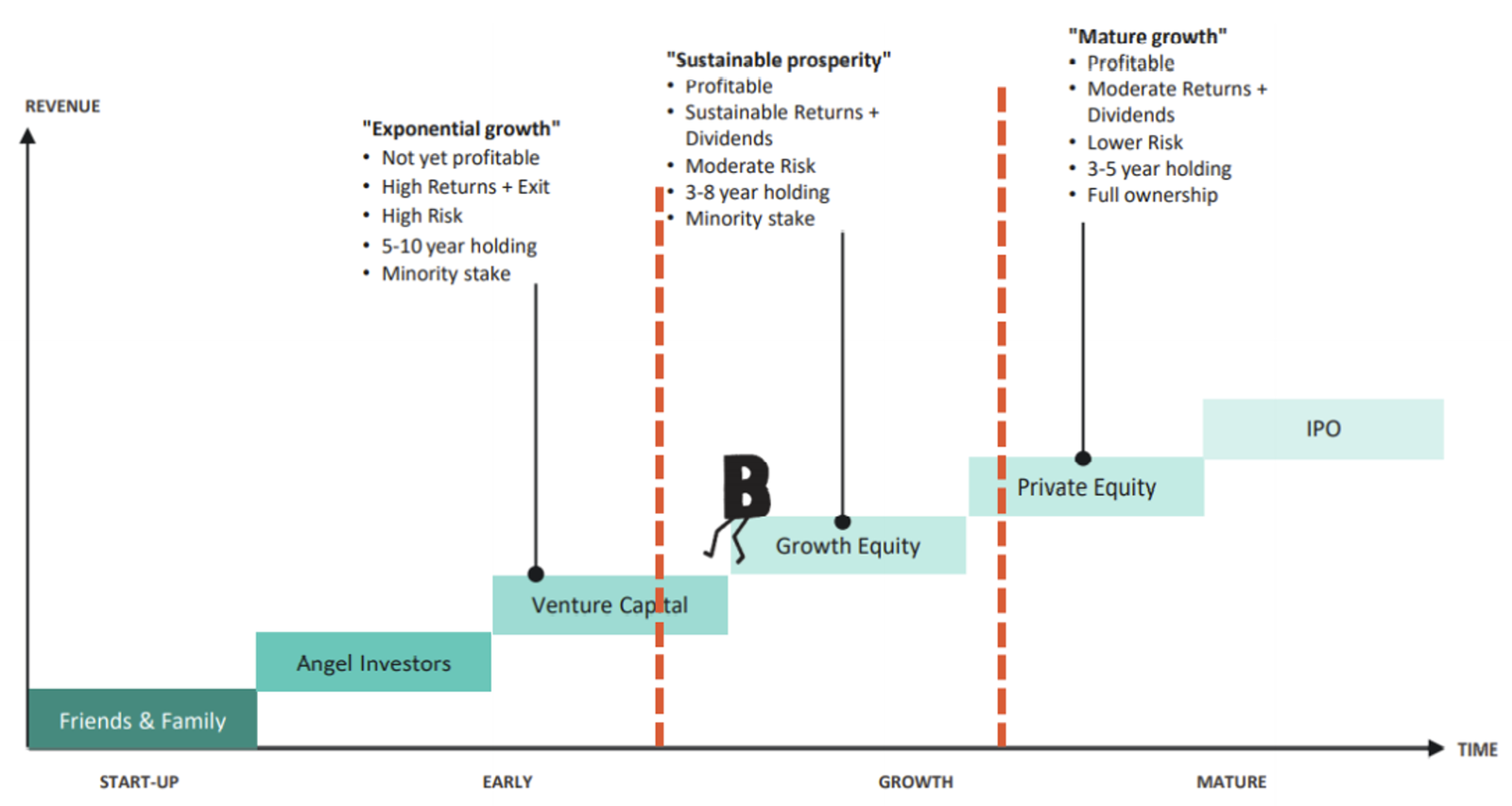

The stage of business growth, also helps determine the difference between private equity and growth equity:

The target returns may also vary between growth equity and private equity, as growth equity typically aims for returns in the high single-digit to the low double-digit range, whereas private equity may set its goals on even higher returns. The primary objective of growth equity is to offer financial resources to support the expansion prospects of companies, whereas private equity typically attempts to enhance operational efficacy and profitability.

Growth Equity vs. Venture Capital: Which is Better?

It is true that venture capital is also focused on high growth, but it should be noted that there are notable distinctions between venture capital and growth equity. In terms of company maturity, venture capital typically targets very early-stage companies that may not yet have a proven business model, while growth equity targets companies that have already demonstrated their potential for growth. Ownership stakes in venture capital tend to be higher than in growth equity, and debt levels may be lower. Investors in venture capital often have a greater degree of control over the company compared to growth equity investors. Target returns may also differ, with venture capital targeting higher returns due to the higher risk involved. The overarching strategy for venture capital is to fund early-stage companies with the potential for high growth and returns.

Exploring the Players in the Growth Equity Market

There are several growth equity providers, including dedicated growth equity firms, traditional private equity firms that have added growth equity to their investment strategies, and venture capital firms that have expanded their focus to include growth equity. A recent report by PitchBook has shown that the market for growth equity investment was steadily growing in 2021. PitchBook reported that the global growth equity deal value has reach $188 billion in the first half of 2021 which was an 83% increase compared to the same period in 2020. Furthermore, a survey conducted by Preqin, an alternative assets data and intelligence provider, revealed that institutional investors plan to increase their allocation to private equity and growth equity in 2022. The survey found that 77% of investors plan to maintain or increase their allocation to private equity, while 68% of investors plan to increase their allocation to growth equity specifically. This indicates a growing trend towards investing in growth equity as an attractive option for investors seeking high returns with relatively lower risk.

Large private equity firms may explore growth equity investing to diversify their portfolios and target companies with high growth potential. Large private equity firms that have traditionally focused on leveraged buyouts (LBOs) have increasingly explored growth equity investing due to several factors, including a desire to diversify their portfolios, the attractive risk-return profile of growth equity investments, and the potential for higher returns compared to other strategies in a low-interest rate environment. Additionally, growth equity investments allow private equity firms to invest in more established companies with proven track records and clear growth strategies, which can provide more stability and predictability compared to earlier-stage venture capital investments. Furthermore, growth equity investments may also provide a hedge against potential economic downturns and the cyclicality of leveraged buyouts.

Assessing the Risk-Return Profile of Growth Equity

A growth strategy is considered the best option for investors looking for a solid risk-return profile because it offers a balance of potential returns and risk. Growth equity investment offers investors the opportunity to invest in a proven business model with a clear path to profitability and a defined exit strategy. At the same time, it also provides the potential for significant capital appreciation. Unlike early-stage venture capital, growth equity investing is less risky because the companies seeking growth capital have already an established business model and generated consistent revenue. In addition, growth equity investing provides higher potential returns compared to traditional buyout investments.

At each stage of the spectrum, the risk-return characteristics vary. Early-stage venture capital investments offer high potential returns but are also highly risky. Later-stage venture capital investments still offer potential returns, but with lower risk due to the proven business model of the company. Growth equity investments offer lower risk with solid returns, while traditional buyouts offer lower returns with lower risk. The returns are usually achieved through a combination of dividend payouts and capital appreciation, which occurs when the company increases its valuation through revenue growth and profitability. Due to these reasons, growth equity offers a compelling option for investors seeking a balance between risk and returns.

Summary

To summarize, growth equity is a form of private equity investment that concentrates on companies expected to experience rapid growth in the coming years. Growth equity investors commonly supply financial resources and tactical guidance to facilitate the attainment of growth objectives by companies. It is likely that they could adopt a more involved style of management to participate actively in the operations of the company. In comparison to other kinds of private equity investments, growth equity is characterized by a relatively lower level of risk and a greater potential for return on investment. Growth equity investments also require an extended holding period, as investors usually retain their interests for multiple years before achieving a return.

Growth equity presents a compelling alternative for investors seeking better returns relative to conventional asset classes and a robust risk-reward profile. Growth equity investors can mitigate their risk exposure while potentially experiencing capital appreciation by investing in established companies with a proven business model and a clear path to profitability. Nevertheless, akin to any financial undertaking, it is crucial to meticulously assess the hazards and potential benefits prior to making an investment.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.