Capital Structure: Understanding its Significance in 2023

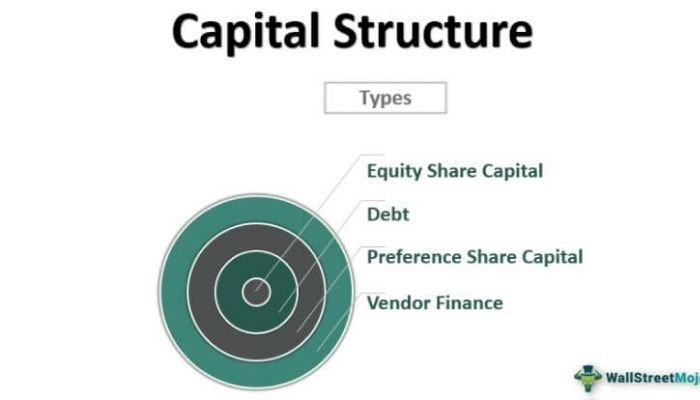

Capital structure surely plays a vital role in business finance. A company’s capital structure is the combination of equity and debt used to fund its operations, investments, and growth.

Companies must strike an optimal balance between these two forms of financing when creating their capital structures in order to minimize costs while ensuring sufficient liquidity for day-to-day activities. Finding this delicate balance is actually very essential for businesses looking to maximize returns on investment (ROI).

Contents

Understanding Capital Structure

Components of capital structure (debt, equity, and hybrid securities)

Capital structure refers to the composition of a company’s funds, including both liabilities (debt) and owners’ equity. Debt commonly takes the form of loans or bonds issued by financial institutions while equity may include common stock as well as other capital sources such as retained earnings.

Hybrid securities are instruments with characteristics between debt and equity that can be used for financing purposes. All three components provide distinct advantages in terms of cost, flexibility, liquidity risk among others but also come along with different kinds of risks which must be evaluated before one is chosen over another for funding an organization’s operations.

Trade-off theory and the Pecking order theory

The trade-off theory argues that there exists an optimal capital structure at which point a firm can maximize its total value by balancing debt with equity in order to minimize its costs.

On the other hand, pecking order theory proposes that firms follow a hierarchical system when financing; they first look for internal sources such as retained earnings or depreciation allowances before turning to external ones like debts or preferred stock offerings.

This preference reflects managers’ aversion towards issuing diluted shares while maximizing gains from lower interest rates associated with taking on more leverage than what share price might indicate.

Importance of Capital Structure

Relationship between capital structure and financial risk

Capital structure plays an important role in determining the overall financial strategy and cost of capital for a business. The impact of capital structure can be seen on two levels:

First, it affects how much interest must be paid on borrowed funds; Second, higher debt financing also increases financial risk by exposing a company to potential default or bankruptcy risk if profits decrease.

To ensure optimal performance while managing risks at sustainable levels, companies should choose their level of borrowing carefully so as not to overextend themselves financially.

Effect of capital structure on company valuation

Capital structure has a direct influence on the cost of capital. Companies that maintain an optimal mix of debt and equity are able to access more resources at lower costs from creditors, leading to reduced interest payments and higher returns for investors.

Additionally, companies with sound capital structures tend to enjoy higher valuations in comparison due since their perceived risk is much less than those who rely heavily upon leverage finance or risky securities such as derivatives.

As such, it is imperative for businesses seeking successful financing strategies to constantly monitor and optimize their real-world applications through different types of asset allocation measures in order gain long-term financial stability while ensuring maximum return potentials.

Factors Influencing Capital Structure

Industry norms and standards

Industry norms and standards play an important role when it comes to determining the optimal capital structure.

Businesses typically aim to match their ratios of debt-to-equity with those of other firms in their industry, as smaller variations can have a dramatic impact on cost and risk profiles. Industry culture also plays a role here, since different industries tend towards wider or narrower ranges for certain financial metrics relative to each other.

Generally speaking, businesses should keep up with both traditional benchmarks within their sector as well as macroeconomic shifts that may prompt changes across multiple sectors at once if they want successful outcomes from capital structure optimization efforts.

Company size and growth prospects

Company size and growth prospects are important factors that influence capital structure decisions.

Companies with low profitability or limited asset bases tend to rely more heavily on debt financing for their operations, whereas larger companies have access to a wider range of investment options including equity instruments and hybrid financings such as convertible bonds.

Growth prospects also play an integral role in determining the optimal mix of securities; rapid expansion means businesses require additional capital while maintaining lower risk profiles than those carrying significant debt loads.

As a result, it is critical for firms to make informed decisions about which types of investments best suit them given the scope and nature of their business goals.

Tax policies and regulations

Tax policies and regulations are important factors to consider when determining the optimal capital structure for a business.

Companies need to weigh up different tax implications, such as taxes on income, dividends paid out by corporations, interest payments on debt securities or long-term loans etc., based off of their type of entity (corporation versus pass-through entity) and regional laws in order to maximize benefits from an appropriate financial leverage standpoint.

The ability or inability to deduct interest expense can have major effects financially so businesses should carefully evaluate these matters prior making any decisions concerning their capital structures.

Availability of capital in the market

The availability of capital in the markets is a major factor that can influence how companies structure their financing.

The cost and terms associated with either debt or equity are important components to consider when assessing which type of financing may be more beneficial for any given situation.

Companies have access to both public markets as well as private sources, giving them options from where they can get funds at attractive rates depending on current market conditions and investor sentiment towards particular industries or even individual securities issuer.

Optimal Capital Structure

Strategies for finding an optimal capital structure

There are a variety of strategies that can be used in order to find the best combination of debt, equity and hybrid securities based on each company’s specific circumstances including industry norms/standards, size & growth prospects as well as tax policies & regulations.

Through financial ratios such as leverage ratio or gearing ratio businesses can come up with their optimal capital structure by taking into consideration all risk factors involved; ensuring proper distribution between equity and debt components thus achieving a satisfactory balance for greater returns over time.

The role of financial ratios in determining an optimal capital structure

Financial ratios are one of the most important considerations when determining an optimal capital structure. Ratios including debt to equity ratio, interest coverage ratio, and operating profit margin can all help reveal a company’s financial performance in relation to its capital structure so that managers can make informed decisions on how much debt or equity is needed for their organization going forward.

These metrics provide valuable insight into cash flows from operations as well as present day borrowing capabilities which will ultimately have an impact on future financing needs by the firm.

Real-World Applications

Recent trends and developments in capital structure optimization

Recent trends in capital structure optimization include an increasing focus on risk management and control, as well as greater attention to understanding the balance between debt and equity.

Companies have adopted strategies such as refinancing existing debt or issuing new stock offerings/bonds with better terms than their current securities. Furthermore, businesses are leveraging technological advancements such as artificial intelligence (AI) systems to identify corporate actions that may improve overall financial performance while minimizing risks associated with financing decisions.

Such developments along with other strategic initiatives can help companies achieve a more optimal level of leverage depending upon their industry conditions at any given point in time.

Impact of technological advancements on capital structure

In the modern era, technological advancements are increasingly impacting capital structure optimization. Thanks to technology and big data analytics companies have access to more information than ever before which can help inform their decisions on how best to optimize their capital structures in order for them earn maximum efficiency from it while also minimizing associated risks.

This includes making informed judgments about debt versus equity investments as well as understanding market dynamics such as government regulations that may impact specific assets or financial instruments.

Moreover, predictive models developed through artificial intelligence (AI) algorithms enable firms to gain valuable insights into trends and patterns involving a range of factors influencing optimal capital structures so they remain competitive amidst an ever-changing economic landscape in 2023 onwards.

Future prospects and challenges for optimizing capital structure in 2023

The future of capital structure optimization in 2023 looks promising. Technology advancements will likely continue to make the task easier, more efficient and cost-effective; however, business owners must remain informed about new developments such as artificial intelligence (AI), automated analytics tools, and data mining systems that are being developed for this purpose.

Additionally, they need to be aware of changing tax policies or regulations at both the state/local level which might present unexpected challenges when trying to optimize their own company’s capital structure. Despite these potential setbacks though, with proper planning businesses should still take advantage of all available resources in order achieve optimal results by taking full consideration into external factors impacting their financial situation moving forward until 2023 arrives.

Conclusion

Capital structure optimization is a complex and essential process for businesses looking to maximize their financial standing. Characteristics such as industry norms, company growth prospects, tax policies, and the availability of capital in the market can all influence an optimal capital structure. Recent trends suggest that technology has made optimizing one’s capital become easier than ever before with numerous case study examples spanning various industries illustrating different strategies used for achieving success.

As we move forward into 2023 it will be critical that companies remain cognizant of how quickly markets are changing and leverage the new available tools if they desire to become more profitable operations on both short-term objectives while planning long-term health simultaneously.

In conclusion Finding just balance between debt & Equity funding could help Companies reach their goals weight less loss because analyzing risk associated with each technique allows investors make right decision depending upon current situation& potential future impacts.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.