Buy-Side Timeline: Sourcing Deals in Corporate Development

Corporate development is an important strategy that many organizations use to further their growth and expansion. Through mergers, acquisitions, divestitures, and joint venture agreements, companies can grow internally without having to increase capital investments or absorb new liabilities. This process typically involves buy-side deals—strategic transactions where one company buys another one or a stake in it.

In this article, we’ll cover the basics of buy-side deals in corporate development by walking through the typical timeline between sourcing potential targets and closing a deal.

We’ll discuss how to reach out to target companies, review financial information and conduct due diligence, value the purchase price, negotiate terms and conditions with sellers/intermediaries, and close the transaction properly. Along the way, we’ll highlight the importance of doing thorough research upfront and managing post-acquisition integration should a successful deal occur.

Contents

Identifying Investment Opportunities

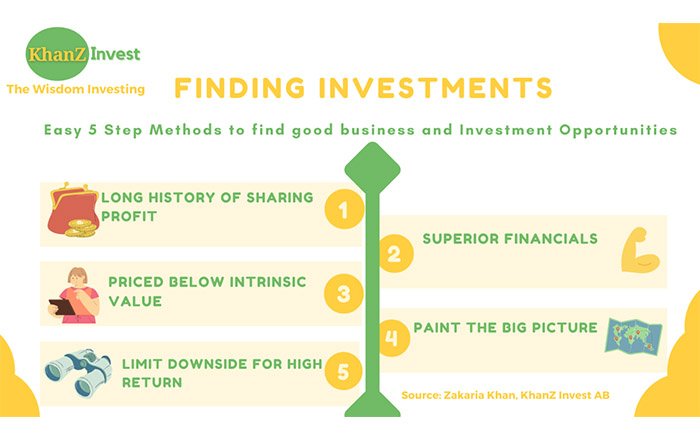

When it comes to identifying potential investment opportunities within the corporate development process, the first step is refining available resources and evaluating a company’s financial climate in order to set up scope and criteria for the acquisition endeavors.

This includes defining ownership objectives based on qualitative or quantitative metrics, forming selection features that target suitable candidates (e.g., determinants like customer base, dynamic pricing model, etc.), taking into consideration risk tolerance assessment, setting budget caps for individual opportunities as well as accumulating funds necessary prior to proceeding with value bids.

Accurately defined investment objectives help buyers create acquisition roadmaps clearly aligned with their current and long-term strategy.

Conducting market research and industry analysis

Conducting market research and industry analysis is an important step when trying to identify potential investment opportunities. Market research involves collecting data about competitors, customer trends, recent acquisitions, peers in the industry, and emerging technologies related to the company’s activity.

Industry analysis looks at the macroeconomic landscape of a particular sector– such as macro trends driving growth or introducing headwinds– helping corporate development professionals assess how attractive their target companies could be for acquisition from a longer-term perspective.

By understanding what other companies (or direct competitors) currently offer in terms of products or services and exploring potential entry strategies or M&A trends that drive merger activities across industries, buyers will have moved one more step closer to pinpointing lucrative targets for acquisition.

Identifying potential targets and acquisition candidates

Identifying potential targets and acquisition candidates is a vital step in sourcing deals for corporate development.

Investing companies must define clear objectives and criteria to help guide their searches, as well as conduct market research and industry analysis to assess available opportunities.

After creating a shortlist of promising acquisitions or collaborations, they can reach out to the target company directly or through intermediaries such as investment banks and merger & acquisition (M&A) advisors.

Then they can collect and evaluate preliminary information about those businesses before deciding whether they merit further investigation through due diligence processes.

Initial Contact and Evaluation

Reaching out to target companies or intermediaries

Once an investment opportunity has been identified, corporate development must reach out to the target company or to factoring agents and/or intermediaries in order to initiate a deal.

This process of contact should be customized for each specific prospect: methods of communication (email, telephone call, etc.), key messages (background on the interested party, summarizing reasons why this could be an interesting move, etc.), and expected answer times should all be clarified before any outreach is initiated.

All communications sent initially need to comply with applicable legal norms and regulations– above all else making sure that any type of sensitive data required (personal outcomes) need to remain confidential along with privileged information according the Non-Disclosure Agreement being signed by both parties beforehand.

Signing non-disclosure agreements (NDAs) for confidentiality

Signing non-disclosure agreements (NDAs) is integral for successful communication with target companies without compromising either party’s protected information and intellectual property rights.

NDAs play an important role in helping secure confidential disclosures between both parties and avoiding litigation as a result of unauthorized sharing or misused information.

By demonstrating a high level of professionalism, clear expectations regarding confidentiality, and mutual respect for disclosure requirements during early discussions with acquisition targets will go a long way in establishing trust and loyalty upon deeper engagement throughout the transaction process.

Collecting and evaluating preliminary information

Collecting and evaluating preliminary information is a critical step in the initial contact and evaluation of a potential deal.

Through this process, corporate development teams research current market trends, target company products and services, customer profiles, competitive landscape, and upcoming opportunities or challenges impacting the business.

This also involves obtaining documentation such as annual financial reports and proactive legislative action other for due diligence later on in order to assess all of the applicable risks associated with entering into that purchase agreement.

Conducting Due Diligence

In-depth assessment of the target company’s financials, operations, and legal status

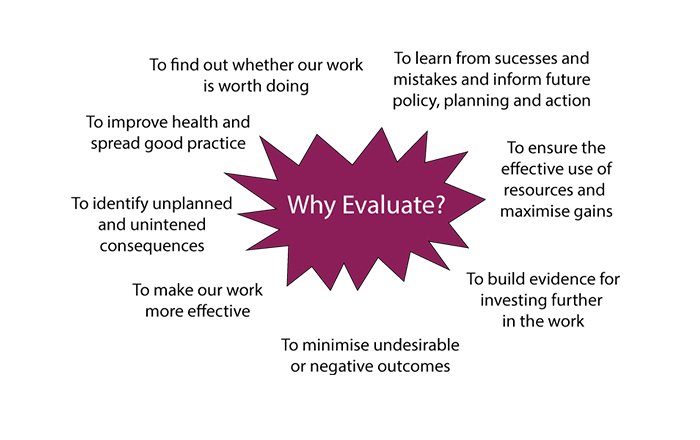

Conducting due diligence is a crucial step in the buy-side timeline. It involves an in-depth assessment of the target company’s financials, operations, and legal status in order to identify potential risks and opportunities associated with the deal.

This process includes verifying available information and requests granular details such as contracts, internal documents, tax returns, etc., which requires experienced professionals from areas like accounting, finance, or law.

Ultimately with accurate assessment practices corporate development teams can gain confidence before moving forward on the transaction phase.

Identifying risks and opportunities associated with the deal

Due diligence is an important process when sourcing a buy-side deal. During due diligence, the acquirer evaluates the target company’s financials, operations, and legal status to identify any risks as well as potential opportunities associated with the transaction.

This could include anything from analyzing prior financial performance in order to assess value among other criteria to negotiating financing terms or researching intellectual property that could potentially be useful for future expansion.

All of this information helps develop an understanding of how this particular acquisition will impact the acquiring company going forward.

Analyzing synergy potential and compatibility with the acquiring company

Conducting due diligence on contribution mergers enables buyers to assess the potential synergy of merging companies.

First, from a financial standpoint, buyers should analyze market performance as well as each company’s top line growth and bottom-line profitability. Second, it also taps into the corporate structure – particularly how strategic business units and departments operate.

Additionally, understanding corporate identities serves organic integration rather than abrupt merger shock down the road. Finally, measuring operational compatibility examines timetables and distributed workloads within each organization for seamless collaboration post-merger.

Valuation and Deal Structure

Determining the value of the target company

Valuation and Deal Structure are essential steps in the buy-side process of corporate development. Determining the value of a target company involves analyzing several key financial metrics such as price/earnings, free cash flows, accruals, industry comparables, and maintenance costs.

Understanding shareholders’ expectations can play an important role too; typically companies expected to be sold inside five years are evaluated at higher premiums than those not considered to have timely takeover prospects.

Industry experts also use various valuation methods (e.g., discounted cash flow (DCF) approach) for getting accurate valuations depending on the situation and preference.

Evaluating different deal structures (e.g., cash, stock, earn-outs)

Valuation and Deal Structure is a major step in the buy-side deal process which involves determining the value of an asset, negotiating terms and conditions with the target’s representatives, and evaluating different deal structures.

Evaluating different deal structures entails looking at options such as cash, stock or equity-based payment, or earn-outs in order to negotiate an acceptable financial side for both parties.

This can be a complex role as there are multiple moving pieces but it is necessary to determine fair economic exchange for two companies to meet their respective evaluations of both themselves when they formally enter into any partnerships.

Negotiating terms and conditions with the target’s representatives

When valuing a target company, analysts must take into account financials, market opportunities, and more.

It is important to enter negotiations with an appropriate value in mind. When negotiating terms and conditions with the representatives of the target’s business, Corporate Development teams will consider mitigating tactics to lower costs such as offering partial payment upfront or allowing strict caveats within contract terms.

At this point in the process, it is important each party has deemed the potential acquisition promising and beneficial before signing any formal agreement.

Finalizing the Transaction

Drafting and signing the Letter of Intent (LOI)

The Letter of Intent (LOI) is an important step in finalizing the transaction and determining whether both parties are interested in continuing negotiations. It typically outlines the terms, such as purchase price, associated conditions, and timeline for due diligence.

The LOI is not binding except for those specific terms that legally must be honored until their inclusion in a finalized contract.

Both parties discuss and agree upon obligations imposed upon signing it such as confidentiality agreement or payment of break-up fees if the deal does not move forward from thereon. Once signed, serious negotiation follows to hammer out all aspects of the deal before proceeding to contract closure.

Executing the Purchase Agreement and other legal documents

When finalizing the transaction, the parties must execute a Purchase Agreement and other legal documents required for closing.

The Purchase Agreement contains provisions outlining which assets will be transferred, any specified conditions for closing, indemnification obligations of the target company or representatives, and payment terms that specify how much of the purchase price will be paid at closing and when remaining portions are due.

It also outlines representations and warranties made by both parties to ensure the accuracy of key pieces of information presented in negotiations about profits/revenues and expenses as well as comply with relevant laws/regulations.

Once a Letter of Intent and Purchase Agreement has been drafted and agreement terms negotiated, it is then necessary to obtain certain approvals from regulatory authorities, shareholders, lenders, the Board of Directors of both companies involved in the transaction, and other third parties.

Companies must ensure that all steps necessary for compliance with legal and contractual obligations have been taken before closing on the deal. Additionally, shareholders may be required to vote on whether to approve transactions that involve fund transfers or acquisitions involving buying/selling company stock.

Ultimately, obtaining all necessary approvals is the last key step in finalizing a buy-side deal in Corporate Development and enables the completion of successful corporate deals.

Closing the Deal

Preparations and logistics

Closing the deal marks a transition of ownership from one party to another. Closing day needs to be properly handled with the right preparations and logistics in order for it to go smoothly. This includes developing closing documents, obtaining buyer/seller hand offs, financing set up fees adjustments, checks processing, concluding risk and debt obligations acknowledgments, etc.

Moreover, accommodating operational instructions like bank account entries and indemnifications prove critical at closure time.

Equally important is handling funds balancing prior to closing decisions being made – reflect bid versus selling price differences and interpretation drafts agreement related filings by governmental bodies including revenue acquisition approvals at respective states where needed.

Ultimately reaching success in executing this phase defines a deal as truly drawn accomplished.

Transferring ownership and assets

During the Closing stage of a Buy-Side deal, ownership and assets are transferred from the Target company to the Acquirer. This is done in compliance with all necessary laws and regulations set by both federal and state governments.

In order to make sure that everything goes smoothly, Executives involved must coordinate the signing of legal documents as well distributors of stocks or cash plays as payment for mergers & acquisitions.

Post-closing involves transfer activities emphasizing capturing specific data related parties entering new legal agreements such as customer lists, non-compete agreements, etc., getting defined goals solidified into contracts, etc.

Thus ensuring smooth transition and integrity of existing covenants f following finalized acquisition of officially owned recognized assets.

Announcing the acquisition to stakeholders and the public

At Closing in a buy-side transaction, the legal ownership and assets of the target company transfer to the acquiring company.

It is important that all stakeholders involved are informed at this point to ensure successful transitioning and integration into the new organization. Communications should be smooth and strategically planned with customized messages for external investors, customers, competitors, industry influencers, etc..

Decisions need to be carefully made around whether distributions will be through digital channels or if press releases are necessary.

Regardless of what method is used each stakeholder should emerge feeling appreciated for their part in welcoming change and cause excitement for the direction ahead as well as audience enlightened about how it is a positive development.

Post-Acquisition Integration

Merging the acquired company with the acquiring company

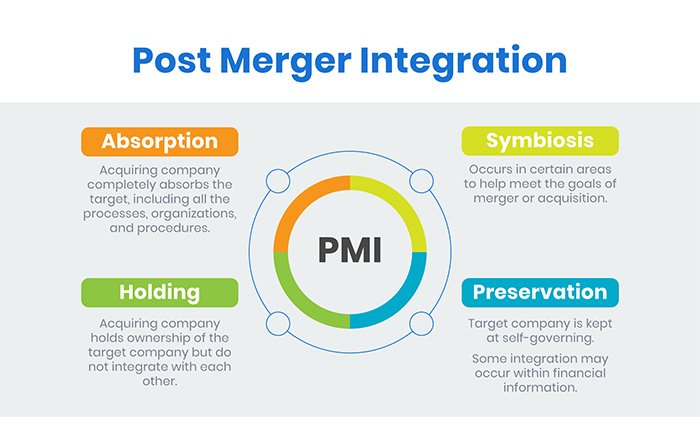

Post-Acquisition Integration is where the newly acquired company is merged with its acquiring party. A key part of this process involves integrating culture, processes, visions, and goals.

In order to properly communicate between two contributors in a successful merger, clear lines of communication need to be created as well as specific responsibilities sectioned off accordingly.

Moreover, identifying areas for potential cost savings while harmoniously consolidating work forces and gaining the trust of their collective employees will form the ultimate desired outcome by meshing two operating businesses together.

Integrating cultures, processes, and systems

Post-Acquisition Integration is an integral part of the Buy-Side process that involves merging the acquired company with the acquiring company while also integrating its operational cultures, processes, and systems.

After closing the deal and transferring ownership and assets, taking steps to maintain harmony between both entities becomes critical.

Executives need to leverage existing best practices that take into account new operations; tweak policies related to areas such as scheduling or HR management shared across organizations; build engagement among staff members coming from both companies.; and monitor overall post-merger performance on a regular basis.

Successful integration ensures beneficiaries for stakeholders involved including investors backing acquisition efforts for ROI return.

Monitoring and managing post-merger performance and synergy realization

After the completion of a buy-side transaction in corporate development, post-acquisition integration is essential. An important part of this process involves monitoring and managing post-merger performance and synergy realization.

Companies must ensure that they are integrating cultures, processes, and systems as well as realizing any synergies expected from the deal.

Necessary steps should also be taken to alleviate risks that could detrimentally affect potential value creation.

Through strategic assessments and diligent follow-up processes derived from an integrated operating plan signed by both parties during transaction negotiations, successful identification of underlying issues can facilitate smooth future cooperation between entities once combined.

Conclusion

The buy-side timeline for corporate development is an important procedure for the successful acquisition of target companies.

By thoroughly researching, carefully evaluating, and accurately valuing prospective targets, companies can determine the most suitable deal structure that maximizes the potential of the transaction while mitigating any risks.

Post-acquisition integration also plays an essential part in the success of any acquisition, as integrating the acquired company’s processes and systems with the acquiring company’s can help ensure the desired synergies can be realized.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.