What is Growth Equity?

Growth equity is an increasingly popular form of private equity investment that focuses on providing capital to growing and scaling businesses. It serves as a powerful tool for entrepreneurs and companies seeking foreign capital without relinquishing significant ownership control while offering access to industry-specific guidance in expanding operations and reaching broader markets.

In today’s volatile economic landscape, understanding the dynamic nuances of growth equity investments has become essential not only for investors but also startups looking at alternative financing options beyond venture capitals or buyouts — both of which traditionally entail more risk with longer time horizons..

As such it’s helpful to understand its definition distinctions from other forms of investing, operational dynamics including sourcing opportunities & managing risks post-investment, exit strategies associated with returns on invested amounts etc., value creation & key benefits as well as challenges associated therein.

This outline provides comprehensive insights into each aspect; thereby enabling stakeholders making informed decisions when evaluating potential partnerships arising out of this strategy.

Contents

Growth Equity

Growth equity as a form of private equity investment

This is a type of private equity investment, typically made in late-stage companies that have existing revenue models and are well placed for rapid growth. Such investments increase the value of these mature business ventures by providing capital to accelerate expansion into new markets or products; develop technologies; make acquisitions and other strategic moves necessary for long-term success.

Growth investors provide not only significant liquidity but also knowledgeable support through active management involvement on issues ranging from corporate strategy development to board representation.

Furthermore, they often invest resources (in addition to money) such as human networks, relevant industry expertise and experiences which can be leveraged in growing their portfolio company’s performance further than it could have achieved without them – something traditional lenders may not offer entrepreneurs or small businesses access too otherwise.

Comparison with Other Investment Strategies

Venture Capital

1. Differentiation between growth equity and traditional venture capital

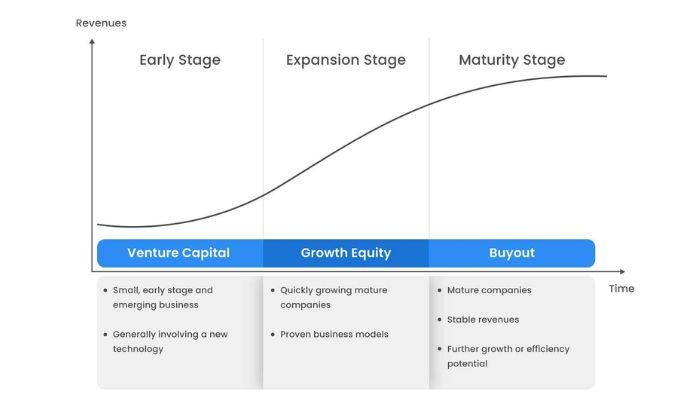

Venture capital and growth equity are both forms of private equity financing, but there is a key distinction between the two. While venture capitalists focus on funding early-stage startups with long-term potential for large returns, growth investors invest in established companies that already have proven track records and market traction.

This makes them better equipped to provide strategic guidance towards scaling operations or accelerating revenue growth via customer onboarding initiatives such as digital marketing campaigns or other support services like legal advice or HR consulting. As opposed to traditional venture capital investments which emphasize risky bets with high unemployment rates, growth investments can be reliably seen as less volatile sources of returns with predictable paths forward due to their attentive involvement throughout a company’s development cycle.

2. Risk profiles and return expectations in venture capital and growth equity

Venture capital investments involve taking high risks in order to earn a higher return. The expected returns are often greater than those of growth equity, due to the early-stage nature of startups and focus on tech innovation that could disrupt an industry or create entirely new ones.

Risk profiles for venture capitalists typically comprise financial risk related to timing/duration mismatch between investing period and exit term; market risk (e.g., macro environment); business model being untested; valuation uncertainty etc.; while return expectations can range from 3x – 8x investment over the medium-to long time horizon with IRR ranging from 20%-50%. Growth Equity investors tend have more moderate capped returns outlook compared with VCs as their lower entry costs usually allow them only 4 – 5X net internal rate of return ROI post partial exits like public listings or sale events at later stages.

Buyouts

1. Distinction between growth equity and leveraged buyouts

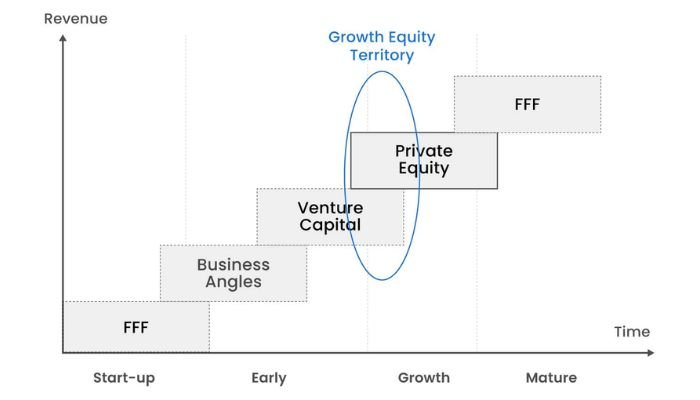

Buyouts are a form of private equity investment that involves purchasing all or a majority stake in target companies. Growth equity investments differ from buyouts as they typically involve taking minority ownership stakes and focus on driving sustained growth rather than fully controlling the company.

Leveraged buyout transactions also rely heavily on debt to acquire assets, whereas growth equity is usually structured without excessive use of borrowed capital.

Another key distinction is their respective exit strategies – while leveraged buyout investors aim for quick returns through operational improvements or strategic acquisitions, growth equities hold longer-term positions focused primarily on providing support and achieving value creation objectives over time before exiting with attractive returns.

2. Emphasis on growth potential and minority investments in growth equity

Buyouts typically involve the purchase of an entire company with debt financing. However, in contrast to traditional buyouts growth equity leverages minority investments for growing companies and emphasizes opportunities that enable continued expansion instead of making quick profits on repackaging a target business’s assets or resources.

Growth investors usually take smaller stakes in businesses but apply their expertise and networks to maximize upside potential by focusing more on organic market share gains rather than cost reductions from economic scale acquisitions.

Consequently, targeting fast-growing markets is common while requiring some degree of assurance as far as execution capabilities go before committing capital – deeming strong management teams essential to successful exits during evaluation processes when looking at longer terms horizons compared with other private equity strategies.

How Growth Equity Works

1. Investment Process

Sourcing and evaluation of potential investment opportunities

Growth equity investors source potential investment opportunities through various channels, including industry networks and trusted advisors. They then evaluate these prospects based on a range of factors to determine if it is an attractive opportunity for growth capital investments.

These factors include the size of the market existing visibility/brand recognition in that particular sector, current business model performance, future expansion plans or projects required to scale operations sustainably over time who are the key individuals at the management level leading decisions related to those activities etc..

Growth equity criteria also take into consideration other external considerations such as macro-economic trends affecting businesses’ success rate, competition dynamics across different geographical regions & what value can they add specifically by investing in this company only.

Due diligence and investment decision-making

The growth equity due diligence and investment decision-making process involves a comprehensive review of the prospective company’s operations, financial health, management team competence, industry positioning and market potential. The investor will perform an in-depth analysis of these factors to determine whether the opportunity meets its pre-defined criteria for attractive returns on invested capital.

Ultimately, investors may leverage their own networks or outside advisors to obtain external perspectives on sector performance trends that could indicate future success or failure risks associated with this particular deal.

Structuring growth equity deals (e.g., equity ownership, minority stakes)

In a growth equity investment, the structure of the deal is an important factor. Equity ownership and minority stakes must be carefully considered to ensure that all parties involved are appropriately incentivized for their contributions.

Investors can have majority or partial control over decision-making to reflect both financial commitment and alignment with strategic objectives. The amount of share in terms of percentage will vary according to each unique agreement depending on the circumstances surrounding particular deals; flexibility is key when negotiating these arrangements so as not to overlook certain contingencies from either side’s perspective.

2. Value Creation and Support

Active involvement and strategic guidance from growth equity investors

Growth equity investors provide active involvement and strategic guidance to help businesses meet their goals. They work alongside founders, management teams, boards of directors and other stakeholders to scale operations, strengthen competitive positioning across markets as well as develop more effective business models that can optimize an organization’s performance.

Investors leverage industry networks and knowledge attained through prior investments in the space which allows them to perform a critical role on driving growth initiatives forward while helping companies obtain desired outcomes efficiently or through cost-effective measures.

Assistance in scaling operations, expanding market reach, and optimizing business models

Growth equity investors not only provide capital but also offer strategic guidance, leveraging their industry networks and expertise to help portfolio companies reach key goals. A major focus of growth equity professionals is assistance in scaling operations to achieve higher returns on invested capital through cost minimization, efficiency optimization, and technology advances.

In addition,growth-equity firms can contribute resources towards expanding a company’s market outreach or strengthening its competitive position within the marketplace for outperformance compared with peers.

Finally, best practices may be applied toward developing good business models that optimize profitability without sacrificing long-term potential or sustainability over time (such as investing customer perspectives into product design).

Leveraging industry networks and expertise to drive growth

Growth equity investors provide significant value to their portfolio companies by leveraging industry networks and expertise. They draw upon a vast network of individuals, sector experts, governmental cooperations etc., to help the company develop strategic growth plans that suit its unique situation.

Skillful financial advisors can also use investment banking contacts as well as other resources such as venture capitalists during negotiations with potential buyers or private-equity firms in order for successful exits from an investment position.

3. Exit Strategies and Returns

1. Typical exit options for growth equity investments

Growth equity investments typically have a long-term investment horizon and can take several years to reach an exit.

Common strategies include:

- Liquidity events such as going public, acquiring or merging with another company

- Strategic sales/acquisitions of the portfolio business to other larger corporations

- Returning capital over time through dividend distributions

- Flipping the growth equity investor’s ownership stake in return for ownership rights

- Returns will depend on different factors like:

- Market environment at exit date

- Length of hold period

- Financing structure during entry point

However they are generally expected to be competitive within private markets due to both risk appetite taken by investors alongside efforts from teams executing value creation initiatives throughout the lifecycle.

2. Expected returns and performance metrics in growth equity

Growth equity investments are typically focused on longer-term returns rather than short-term gains, with a focus on maximizing capital appreciation.

The expected return for these types of deals can vary depending upon the level and type of risk taken by investors – however, in general, growth equity is designed to yield superior investment outcomes over an extended period when compared to other asset classes such as stocks or bonds markets.

Ultimately performance metrics will depend heavily upon particular market factors but key measures that reflect financial success include internal rate of return (IRR), cash multiple and absolute value creation ratio (AVCR).

Conclusion

Growth equity is an attractive and viable investment strategy for both financial investors and entrepreneurs. This private equity approach offers a lucrative combination of returns, long-term support to businesses in their growth period, as well as several potential exit options through which the investor’s portfolio can realize value.

As such, understanding how this type of funding works, and what sets it apart from other strategies like venture capital or buyouts investments is critical if one wants to access its full range of benefits in terms of return on investment (ROI).

By adhering closely to these dynamics and leveraging knowledge about key players involved – assessing opportunities carefully at all stages – investing in Growth Equity should be seen as not only valuable but also a promising tool that likely will continue contributing profoundly allied with today’s endeavors.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.