Protecting Sensitive Data During M&A

M&A involves the coming together of two companies to create a new, larger entity that is better positioned for growth and most especially profitability. While M&A can be beneficial for both parties involved, like any other, it also raises concerns about data security and protection.

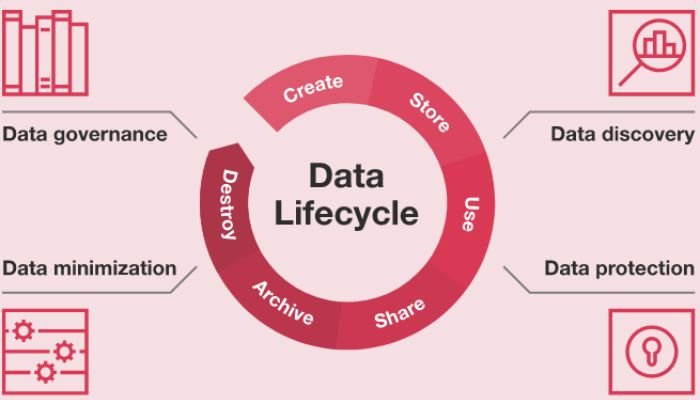

Data is an organizational asset, it is one of the backbones of an organization, without which businesses cannot effectively compete in today’s digital economy or remain compliant with regulations such as GDPR or CCPA. It is therefore extremely crucial to take preventative steps prior to any Merger & Acquisition event to ensure that private customer information remains secure throughout the process.

This article outlines how organizations undertaking an M&A can protect their sensitive data from unauthorized access or manipulation through proper planning and implementation of effective security protocols.

Contents

Identify the Data to be Protected

Define the Types of Data

It is important to define the various types of data that must be protected during M&A. Data can include customer contact and financial information, intellectual property assets such as source code and design documents, or other sensitive business materials utilized by an organization for its operations.

These categories should also encompass data stored in off-shore systems or with third-party vendors if applicable to your transaction. Defining the types of data helps organizations identify vulnerable assets targeted by attackers and focus their protective measures accordingly.

Identify the Location of the Data

Once the types of data to be protected have been identified, organizations must also determine where these datasets are located. Current systems might contain a distributed network with on-premise and cloud infrastructure that can make it difficult to pinpoint the exact location for each set of data.

Tracking down all assets across multiple sites is an important step in assessing potential risks and devising suitable protective measures accordingly.

Conduct a Data Inventory

The third step in data protection during M&A is to perform a thorough inventory of existing datasets. This should include both structured and unstructured forms of data such as databases, application logs or other documents that might contain sensitive information.

The aim is to create an accurate representation of the company’s current state by identifying where each piece of data resides along with any security controls that have been applied to it from external parties. An up-to-date inventory helps organizations take appropriate action for safeguarding their assets both prior and post-transaction closeout.

Conduct a Risk Assessment

Identify Potential Risks

In order to identify potential risks associated with data identified in the prior step, organizations must begin by assessing threats posed both internally and externally.

This means evaluating vulnerabilities based on internal sources such as personnel involved or those who have access to data; external sources which can include malicious actors, unauthorized access from third parties seeking financial gain or espionage etc.; as well as other points of risk related to technical infrastructure and network security.

Evaluate the Impact of Risks

Once potential risks have been identified, organizations must then evaluate their individual impact to determine which ones need greater focus.

The evaluation of the risk should include analyzing details such as data sensitivity, financial and reputational consequence associated with each threat; cost-benefit analysis related to security countermeasures deployed for protection from them; as well as cataloging their feasibility considering available resources in terms of technology or personnel skills needed.

Determine the Likelihood of Risks

In addition to evaluating the impact of each risk, organizations must also consider their likelihood or probability in order to prioritize protection efforts.

Here, relevant data sources such as past experiences and public information related to similar threats should be examined in order to realistically assess potential risks and how likely it is that they will materialize before M&A event takes place.

Develop a Data Protection Strategy

Define the Data Protection Objectives

The fourth step in protecting data during an M&A is to develop a comprehensive data protection strategy. This includes defining clear objectives and determining the necessary measures that need to be taken in order to protect sensitive company information from unauthorized access or manipulation.

It’s important for companies involved in the M&A process to identify what specifically needs defending – such as confidential customer records, employee files, intellectual property etc.,- then architect the appropriate security controls accordingly so that strategically defined goals can be carried out effectively and efficiently.

Determine the Data Protection Mechanisms

The next step in protecting data during an M&A is to determine the appropriate security mechanisms that should be implemented. This can include monitoring user access, encrypting data transmissions, deploying authentication and authorization systems or establishing backup plans so that any critical information lost due to a breach can quickly be recovered.

Companies need to conduct thorough risk assessments for each type of data stored within their systems in order to identify plausible threats then develop corresponding protective measures accordingly. Each mechanism must successfully fulfill its designated purpose while being able accommodate scalability as the company grows over time.

Establish Data Protection Policies and Procedures

The final step in establishing an effective data protection strategy is to draw up guidelines for teams and suppliers involved who access and use the business’s sensitive information.

These policies must include detailed documentation about lawful collection, retention and disposal of records as well as explicit instructions on how authorized personnel should handle any emerging security issues or incidents that may arise.

Companies need to enforce clear boundaries against unauthorized stakeholders from accessing their proprietary resources by implementing tiers of authorization levels which only privileged users can traverse successfully when validating their credentials .

Implement Data Protection Measures

Monitor and Control Access to Data

When it comes to the implementation of data protection measures, monitoring and controlling access to privileged information is actually very crucial.

To keep any confidential data secure during an M&A process, companies must establish a rigorous system for restricting who can view or modify sensitive files.

This requires implementing authentication protocols as well as setting individual user privileges that accurately reflect each person’s level of authority within the organization. Companies also need to set up periodic reviews of all active users in order to ensure their continued eligibility for accessing confidential resources over a long-term period.

Encrypt Sensitive Data

Another important step in data protection is encryption of sensitive information. Encryption refers to the process of protecting private or confidential data stored either internally or externally by transforming it into an unintelligible form through complex algorithms.

This ensures that anyone attempting to gain unauthorized access would not be able to understand or make any use out of the protected files even if they are successfully obtained. Organizations should adopt robust security protocols during their M&A activities and ensure all delicate company data is encrypted for extra layer of privacy and safety.

Use Secure Communication Channels

To ensure that all communications between the two organizations remain secure during an M&A event, it is important to use protected communication channels.

This can include setting up virtual private networks (VPNs) or encrypted messaging systems such as Signal or Telegram to protect any data shared over a public network from potential bad actors lurking outside of both companies’ security perimeters.

In addition, employees should be informed about the importance of avoiding transmitting sensitive information directly in plaintext and establishing strict protocols for securely sharing files with necessary stakeholders involved in the merger-acquisition process.

Establish Data Governance and Compliance

Ensure Compliance with Data Protection Regulations

When establishing data governance and compliance, it is important to ensure that the procedures are compliant with all relevant data protection regulations.

This involves staying up-to-date on any changes in international or national laws pertaining to the transfer of personal data across organizations as well as internal industry standards, customer/partner contracts and other agreements related to privacy.

Companies also need to be aware of risk thresholds when dealing with sensitive information such as health records or financial statements, taking additional steps where necessary for complete compliance.

Establish Data Governance Frameworks

A data governance framework provides structure and direction for organizations when dealing with their private customer or corporate information.

Clear policies need to be established regarding the management of personal data, including which employees have access privileges and under what conditions, who is responsible for executing those permissions and in what manner the rules will be enforced.

Companies must also create a plan on how collected data should be secured during transfers, as well as measures outlining how any breach that may occur can be swiftly identified corrected.

Monitor and Report Data Protection Metrics

Organizations should monitor and report data protection metrics regularly to ensure the effective implementation of their security protocols during any M&A.

Companies should review access rights, detect suspicious modifications or deletions in data records at regular intervals and maintain audit trails for all activity relating to changes made to databases or company systems. This helps improve transparency as employees can quickly track which transfers have been authorized by whom, making it easier to pinpoint malicious activities if they occur in future.

Conclusion

The ability to protect data is a major concern during M&A transactions- as it should be for every firms. Companies must take proactive steps prior to any such event in order to ensure the secure transfer and storage of sensitive information within their systems because if not, consequences are beyond ready to face them.

This proactive steps involves conducting risk assessments, defining objectives for data protection strategies, establishing policies and procedures related to access privileges as well as adhering with relevant industry standards regarding corporate accountability on security breaches or misuse of private customer data.

It is only by following the above mentioned methods can organizations mitigate risks associated with mergers & acquisitions while providing customers with reassurance that their confidential information remains safe at all times.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.