Reasons and Timing Behind Industry Consolidation

Industry consolidation refers to the mergers, acquisitions, and other forms of strategic alliances that occur between companies in a sector or industry with the aim of maximizing their efficiency and profitability.

Consolidation is seen as an important factor for improving accountability, enhancing customer experience, and driving meaningful advancements because it allows enterprises to achieve superior levels of scale flexibility at lower costs.

As such, there has been increasing research into understanding why this form of corporate maneuvering invariably occurs by looking closely at what factors trigger them (demand shifts, regulatory changes) as well as how these strategies are implemented (economies-of-scale).

Contents

Theories Behind Industry Consolidation

Economies of scale

Economies of scale refer to the cost advantages that a business can gain from increased production, such as reductions in materials and labor costs.

When it comes to industry consolidation, this could be realized through larger firms using their greater access to capital resources and economies of scale offered by large-scale operations or joint ventures with other companies.

This allows them more capability for research & development projects which are essential factors in industries with the high technological competition due to their ability both lower prices while creating higher quality products than smaller competitors.

Increased market power

Increased market power is one of the key theories behind industry consolidation. Mergers or acquisitions are motivated by a desire to increase the company’s influence and leverage in their respective markets, enabling them to set prices and have an advantage over competition which may not hold similar levels of stock.

As companies become bigger they gain more control over production capacity and consumer base access, gaining even further earning potentials at higher margins compared with smaller firms operating in overcrowded industries.

Cost savings and efficiency

Cost savings and efficiency is a key factors behind industry consolidation. Through the aggregation of companies, new economies of scale can be achieved that bring down costs while increasing efficiency through increased specialization and resource optimization.

This often leads to cost reductions for consumers in terms of lower prices, as well as improved product delivery times which benefits everyone involved.

By joining forces with similar players across industries, these newly consolidated firms also gain access to larger markets where their actual or potential sales increase dramatically due to reduced competition from smaller competitors who are unable to stay afloat amid rising market pressures.

Synergies and complementary resources

Synergies and complementary resources play an important role in industry consolidation. By combining two or more businesses, the new entity can achieve greater success than neither one could have achieved separately by leveraging each other’s strengths to gain a competitive advantage.

These advantages include shared cost savings from scale economies, increased market reach through combined marketing efforts as well as access to complimentary technological capabilities or specialized expertise needed for development projects.

This strategy of comprehensive integration helps reduce duplication of effort thus making industries better integrated but also reduces competition giving the merged business a larger chunk of the overall market share which may be lesser beneficial for customers and smaller competitors operating in these sectors.

Barriers to entry

Barriers to entry refer to the obstacles which make it difficult for new market entrants to challenge existing players in an industry.

In terms of consolidation, barriers work as a defensive mechanism that allows incumbent companies considerable control over markets and prices.

Examples include:

- Patents

- Certificates

- Licenses required by law

- High capital requirements

- Network effects (e.g., brand loyalty among customers)

- Customer switching costs if changing suppliers will be costly).

These factors are usually what drive industry consolidation as incumbents can easily keep competition at bay and buy out smaller competitors who cannot find ways around them.

Factors that Influence Industry Consolidation

Changes in market demand

Changes in market demand are one of the key factors that influence industry consolidation. Companies can move to consolidate their industries when they anticipate changes in consumer tastes and preferences, or when there is a shift towards new product categories within an existing sector.

They may also restructure if the unmet customer needs become more apparent and difficult for them to compete on going it alone without any scale advantages. Consolidating allows companies to react quickly by leveraging assets while responding proactively and cost-effectively with better offerings than would be possible independently.

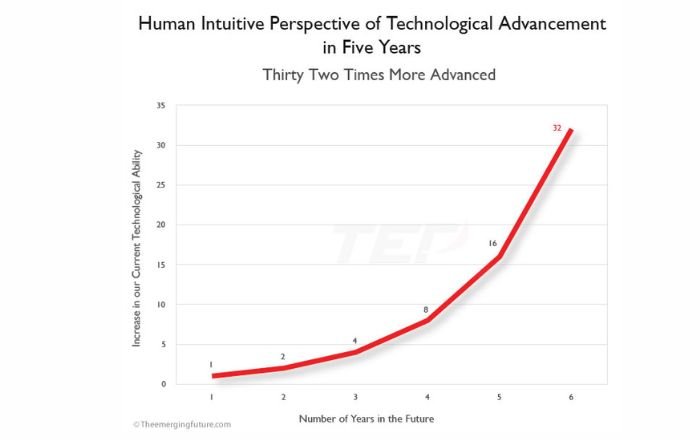

Technological advancements

Technological advancements often play a major role in influencing industry consolidation. New technology can drive changes in market demand, as consumers are drawn to new products and services; however, technologies may also reduce the cost of production for established firms or provide competitive advantages by providing access to valuable data that was difficult or impossible before.

Furthermore, industries with high startup costs such as aerospace rely heavily on technological advances which enable investments at lower risk by decreasing the entry barriers they face while seeking growth opportunities.

Regulatory changes

Regulatory changes often have a big impact on Industry Consolidation. The deregulation of many industries such as telecommunications and airlines has created opportunities for corporations to merge, leading to increased market power and reduced competition. Additionally, new regulations may set up incentives that encourage companies in an industry sector to consolidate or inhibit consolidation – either by providing tax benefits or enacting anti-trust measures respectively.

It is important for businesses looking at consolidation strategies, customers impacted by the resulting monopoly powers gains, and policymakers drafting legal frameworks governing these connections all understand how regulatory changes can influence mergers within their respective markets

Mergers and acquisitions Activity

Mergers and acquisitions (M&A) activity influence industry consolidation because it allows companies to merge or acquire others in order to gain greater market power. Additionally, M&As enables companies to benefit from economies of scale as well as access new resources and technology that can help them remain competitive within their industries. The Globalization also increases the amount of competition for a particular company since foreign competitors become possible through increased global connectivity between different countries’ markets.

Globalization and international competition

Globalization and international competition can be important factors shaping the direction of industry consolidation. As foreign markets become more accessible, companies have the incentive to expand their reach across borders in order to capture additional market share or access better resources and technologies.

This increases pressure on domestic firms to consolidate internally between subsidiaries or branches as well as externally by merging with other regional players in order to continue competing at a global level – effects that are seen most significantly within industries such as banking, telecommunications, pharmaceuticals, and airlines.

The Stages of Industry Consolidation

Stage 1. Fragmentation stage

The fragmentation stage is the earliest of the stages in industry consolidation. This involves a large number of small firms vying for market share, typically with no one firm dominating by size or power.

Competition between these smaller players drives prices down as profits remain low and new entrants continue to enter an otherwise crowded marketplace. During this time there remains potential for strategic alliances that could provide stability but often such relationships do not survive due to a lack of trust among competitors and uncertainty about how long they will last given high churn rates within fragmented markets.

Stage 2. Consolidation stage

The consolidation stage of industry consolidation is a period when larger companies begin to acquire smaller competitors, creating fewer but larger businesses in the same industry. Companies benefit from increased market share and financial synergies that result from being part of a bigger business entity.

This phase can create disruption as well which may lead to job losses or other negative economic effects like reduced competition driving up prices for consumers. At this point, competitive pressures are higher while customers have fewer choices compared with before the process began though large successful mergers at this stage often bring long-term benefits such as improved products and services due to innovation enabled by economies of scale achieved during periods of consolidated operation.

Stage 3. Mature stage

The Mature stage of industry consolidation occurs when market conditions are relatively static, characterized by a few large players dominating the space. In mature stages, there is little prospect for new entrants as barriers to entry become higher due to existing levels of competition entrenched into an established structure.

Prices tend to be high while innovation and quality stay low in order to squeeze out efficiency from cost savings over time acquired from mergers and acquisitions during previous Consolidation phases. The power balance shifts dramatically where larger firms have more influence on customers’ choices with their strong brand recognition combined with loyalty programs offering discounts or preferential offerings for certain products & services which keeps them ahead of peers within the same product class.

The Pros and Cons of Industry Consolidation

Advantages for companies

The advantages for companies of industry consolidation include enhanced market power, increased competitive positioning, cost efficiencies, and synergy attainment.

This, in turn, allows firms to:

- Better negotiate with suppliers and customers for advantageous terms or economies of scale savings;

- Facilitate the entry into new markets that would have been too costly otherwise due to barriers such as technology requirements;

- Access larger pools of capital from investors more readily on account of perceived reduced risk alongside higher levels creditworthiness attractiveness rating by agencies

Disadvantages for customers and smaller competitors

The main disadvantage for customers and smaller competitors of industry consolidation is decreased market competition which can lead to higher prices, reduced choice, and lack of innovation.

This potential decrease in price competitiveness, when businesses merge or acquire, may result in the end consumer having fewer options for goods/services as well as facing higher costs if there are no equally competitive alternatives in the marketplace.

Smaller firms also face negative impacts from large companies consolidating their industries since they have a difficult time competing with these larger players due to lower economies of scale; this creates even further pressure due to increased cost pressures that could drive them out altogether.

Strategies for Surviving Industry Consolidation

1. Diversification

Diversification is a key strategy for surviving industry consolidation. This involves companies expanding into new markets, products, and services to minimize potential risks from unforeseen external events in their existing industries.

Companies can also diversify geographically by developing overseas operations or forming strategic alliances with other firms operating in foreign countries to gain access to different resources, technologies, and customer bases that could offer competitive advantages against rivals in the same sector.

Diversifying appropriately requires careful planning and analysis of the risk/return ratio before any move should be made – otherwise, it may backfire if unspecified variables are encountered on entry into unfamiliar territory.

2. Innovation

Innovation is essential for companies hoping to survive industry consolidation. Identifying and investing in new products, services or processes can help firms differentiate their offer from others on the market which could hold off competitive pressures from larger organizations.

Companies should focus on evaluating customer needs and staying up-to-date with relevant research/trends to ensure that they remain ahead of the game when it comes to innovative solutions. Additionally, collaboration between businesses may be beneficial as different companies are likely able to share knowledge & resources while working towards collective success within the marketplace.

3. Collaborative partnerships

Collaborative partnerships can provide a way for companies to survive industry consolidation. These cooperative arrangements involve two or more parties agreeing to work together and share resources.

Such alliances enable businesses to reduce costs, pool their expertise, access new markets and opportunities quickly by combining products or services in innovative ways, as well as draw on different sources of capital with minimal risk exposure while garnering greater brand recognition if each partner actively promotes the joint venture.

Ultimately however careful consideration needs to be taken before entering into any collaborative partnership since control may become an issue due to mismatched expectations from both sides leading to potentially irreconcilable differences over time that could prove difficult for all concerned.

Conclusion

Industry consolidation is an important phenomenon that has implications for companies, customers, and the wider economy. By understanding the theories behind it, such as economies of scale or increased market power, factors influencing its timing such as technological advancements or changes in global competition can be identified more easily. It also occurs over distinct stages from fragmentation to maturity with both advantages and disadvantages along the way.

Companies must consider strategies like diversification and innovation if they are going to survive industry consolidation while policymakers should keep track of recent trends so that negative impacts on smaller competitors may be mitigated accordingly.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.