Horizontal Integration: Understanding Its Mechanics

Horizontal integration is an important but misunderstood business strategy used to quickly expand both the scale and scope of a company’s operations. Its effectiveness relies on creating critical synergies that can maximize available resources into higher levels of capabilities and competencies across two different organizations.

In this blog, we define horizontal integration, explore its mechanics in how it operates, evaluate variations through acquisitions and strategic alliances as well as enumerate advantages and disadvantages. We ultimately assess the impact it has on business profitability while exploring implications for future decision-making.

Contents

How Horizontal Integrations Operate

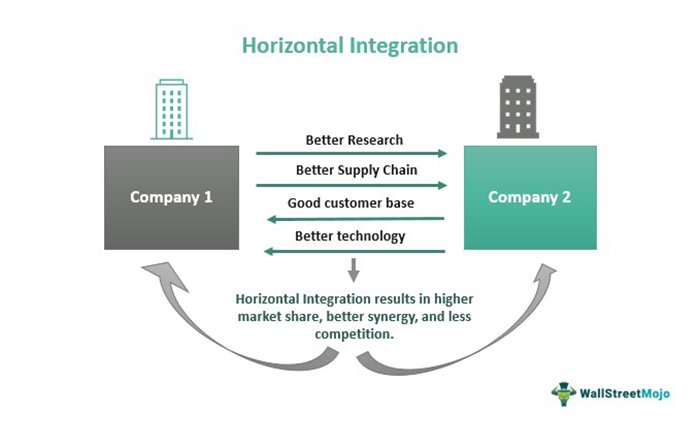

Horizontal integration is a strategic process whereby two or more organizations in the same industry collaborate to achieve common objectives and goals. It typically includes merging businesses with one another or acquiring of partially owned subsidiaries. Through this process, companies can synergize their combined resources – personnel, infrastructure, technology – to optimize efficiency while reducing costs in order to be nationally as well as globally competitive.

Thus, instead of operating separately from each other, horizontally integrated ground-level managers strive for mutual gains and benefit their employers through collaborative effort and information sharing between them.

The ultimate goal is the creation of shared value that enhances efficiency levels among firms engaging in vertical market segmentation by eliminating overlapping operations so as to reduce costs associated with such monopolies within industries that are risky endeavors without such a strategy in place.

Key Objectives and Goals

The key objectives of horizontal integration involve creating an interdependent, or integrated, consolidated base among separate entities. These entities can either be different brands within the same industry or related products and services offered by another company. The goals of joining forces emphasize maximizing profits through scale efficiencies, growth opportunities access to innovation and technology.

Horizontal integrations are structured in a way that builds mutually beneficial relationships between organizations, therefore enhancing competitiveness and decreasing risks from possible coordination barriers.

As these entities contribute in collaborating with their partnered organization they now have access to greater economies of scale thus reaching larger markets faster than before attaining higher levels of profitability for all involved parties.

Role of Companies Involved

The role of the companies involved in a horizontal integration will depend on which type of structuring is being implemented. Generally, the two merging or acquiring firms either need to combine operates in order to benefit from synergy opportunities or reorganize operations so that each performs certain tasks more efficiently than had they remained separate.

In mergers and acquisitions, one partner typically serves as the dominant element while maintaining control over the overall direction and decision-making process.

However, it is important for both organizations to provide input throughout the process in order for balanced, synergistic outcomes to be produced by horizontally restructuring businesses.

Lastly, strategic alliances are limited partnerships between firms where they collaborate together through legally binding agreements; in this case, many roles are equally shared among management teams regardless of size or headquarters.

Different Forms of Horizontal Integration

Horizontal Integration via Mergers

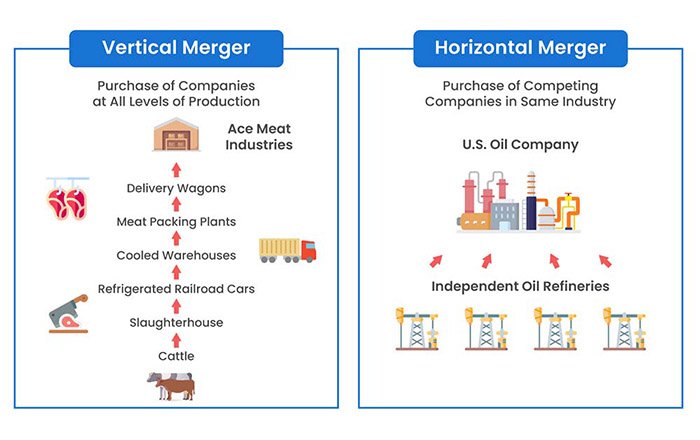

Horizontal integration via mergers involves combining two companies with equal amounts of market share in a product and geographically close operations. It results in an increase in output capacity, greater range, economies of scale, marketing power, geographical reach, and finance among others.

Merging is an anticipated consequence on occasions when competitors may be restricted from merging but are likely to combine if restrictions were not in-place. Companies typically pursue this form of horizontal integration so as to obtain assets which can bolster revenue opportunities or build monopoly profits over territories and markets that have inadequate pricing competition.

This practice also yields advantages pertaining to technological advancement such as acquiring patent licenses and increases strategic control by gaining access to emerging markets featuring higher profit margins for predatory players.

Horizontal Integration through Acquisitions

Horizontal integration through acquisitions is when a company expands by purchasing its direct competitors. This strategy involves two businesses of equal size that have the same products and/or services.

It can be used to benefit cost savings, market share, access resources or technology from multiple companies and move corporate labels under one chain. One downfall of horizontal integration through acquisitions is potential antitrust legislation for creating monopolies in certain industries.

Companies must weigh the possible increased benefits against significant anti-trust regulations they may incur before pursing an acquisition situation. Acquisitions offer capabilities that could lead to future strategic advantages, but legal considerations need to taken into account as well.

Strategic Alliances and Collaborations

Strategic alliances and collaborations represent another form of horizontal integration. This strategy involves two or more businesses entering into a partnership to share resources, talent, investments, and materials between each other across different areas in order to reach a predetermined set of goals.

As opposed to mergers and acquisitions which focus on the assets held by individual companies for the benefit of one particular company, strategic alliances involve two entities that are aligned to increase their profits together.

This model creates benefits such as increased market presence & staying competitive against larger players within the same industry. In effect, both partnering firms expand by taking advantage of opportunities available through strategic partnerships instead of going at it alone.

Pros and Cons of Horizontal Integration

Advantages of Horizontal Integration

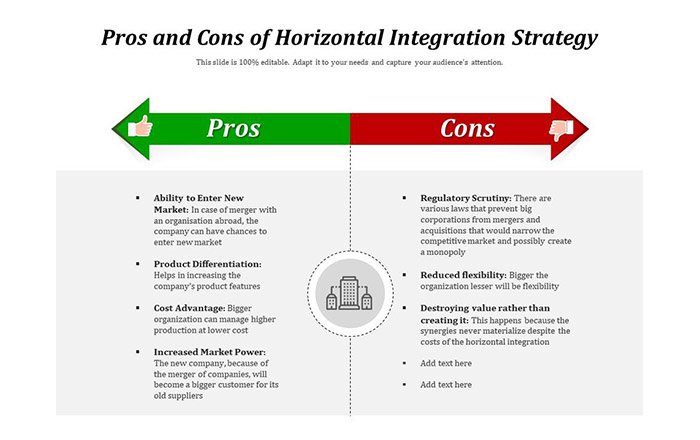

Horizontal integration confers a variety of advantages to businesses that make the decision to pursue it. These include an enhanced market presence and competitive edge, greater economies of scale and cost efficiencies, and increased opportunities for growth. It can also lead to improved negotiating power in terms of contracts with suppliers or the use of resources available from other firms.

Moreover, with a larger work force comes access to larger pools or amounts of capital or infrastructure which can be strategically deployed by the firm due to turbulent operational markets.

For instance, companies seeking timesharing services might benefit greatly from optimizing their use amongst member firms as opposed to merely relying on large amounts and contracted service negotiation prices from single vendors or rivals in potentially unstable markets where risks could run high if wrongly managed.

Potential Disadvantages and Challenges

The drawbacks of horizontal integration often center around the issue of decreased competition in the market which can lead to monopolistically high pricing practices that limit consumer choice.

This can also lead to a lack of innovation and reduced quality as there is no incentive to increase product offerings or create cost-savings incentives for customers. In some cases, this type of integration may run afoul of certain anti-trust laws since it affects true market prices, strategies, production, etc., leading to legal scrutiny.

Horizontal integration also does not always bring the optimal scope or level of venture synergy since originally separate businesses have very unique strengths and initiatives which may contradict one another in shared objectives. Finally, overreaching expansion through multiplicity within confounded industries could cause an organization’s efforts to be diluted, thus hampering overall growth instead of creating the desired advantages.

The Impact of Horizontal Integration on Business Profitability

Enhanced Market Presence and Competitive Edge

Horizontal integration provides distinct advantages in terms of increased market presence and competitive edge.

By forming alliances through joint ventures, amalgamation or mergers, firms are able to leverage their resources and attain a higher market share.

Additionally, they may be able to extend opportunities for obtaining better prices and improved servicing for customers as well as closed control over scarce resources that perk up their ability to apply pressure on competitors or adversaries operating in the same business arena.

Horizontal mergers amplify production volume with fewer fixed costs enabling dominant players to acquire larger discounts from suppliers which solidifies under competitive intensity. Moreover by expanding the company’s base, it results in greater monetary fluency which gives less stranglehold thus putting further competition and moats on individual rivals.

Economies of Scale and Cost Efficiencies

Horizontal integrations allow businesses to combine forces and gain cost efficiencies. This is because businesses are able to leverage economies of scale; by increasing their purchasing power, they may secure lower operational costs.

Horizontal integrations also result in substantial gains through streamlined efficiencies on the production side, from reduced labor needs due to better job specialization and more efficient raw material sourcing or delivery schedules.

Further cost synergies come into play when operations can be combined for greater savings on research & development or combined management activities such as accounting or marketing departments that then focus on only the fully-integrated companies instead of two separate entities.

Evaluating the Overall Impact on Profit Margins

When horizontally integrating two or more businesses, organizational leaders often try to consider how profit margins will be affected.

Profit margins can usually result in turnover value being spread more widely than when the entities remain individual. Through income-sharing arrangements, related costs may also be reduced by double-counting benefits (like advertisement and technological investments). Management teams should however study industry-wide market conditions before formulating any long-term agreements.

Increased operations might ultimately lead to pricing pressure from competitors instead of higher profits if no strategic considerations are made.

Conclusion

In conclusion, Horizontal Integration can be a cost-effective tool to gain certain advantages when well implemented. It involves buying out other companies or forming mutually beneficial alliances—all while pursuing the goal of improving market presence above all else.

Horizontal Integration efforts done correctly can help businesses become more efficient and cost effective, significantly increasing margins over time. Overall it is an important tool for businesses, allowing them to better compete in their markets and gain opportunities otherwise unattainable without partners looking to enable fast growth on both sides.

Every business’s unique circumstances and needs must be taken into account before making the decision on how much integration would best serve possible in order to maximize its financial performance within any given industry.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.