Series A, B, and C Funding: Overview of Startup Investment Rounds

The world of venture capital can be confusing for aspiring tech entrepreneurs. Understanding the basics of series A, B, and C funding is necessary to guide start-ups along their journey toward growth and success.

Understanding what series funding is helps with understanding key considerations when applying for such funding from various investors. Series A, B, and C rounds dictate the scale of investments that fund choices related to a startup’s evolution all the way from inception through breakthrough moments on its lengthy path towards exit or next stage of development.

Series A Funding

Series A funding is a round in the venture capital process utilized by startups to secure external investment. It involves raising multiple millions of dollars from one or more financial investors, commonly called venture capitalists (VCs).

It helps companies raise their profile through press announcements and become capitalized through additional cash infusions while expanding available market opportunities.

By investing funds in early-stage ventures, VCs succeed an allowance for influence on issuance structure as well as help developing and implementing size/configuring strategies. Series A rounds typically follow after angel investor funding or other investments made at an earlier stage and allow long term scaling goals to be archived with considerable advantages.

Investors involved

For Series A Funding, investors may include venture capital companies, angel investments from accredited high net-worth individuals. Received funds should give viable traction for the company’s product.

Furthermore, some seed investors might also reinvest and expand their stake in Series A funding if their long-term relationship with the company is trusted.

Overall, early investor engagement sets Stage A Companies up to have better chances of success and preparing for future rounds of money inflow this provides a viable increase in formalized valuations which helps boost public standing.

Key considerations for startups seeking Series A funding

For startups that want to seek Series A funding, there are several key points to consider. For instance, startups should have a documented business plan and product roadmap that can show investors their potential for growth.

The pitch must also provide an understanding of expansion plans and why the Company can influence its target customers in lieu of competitor brands. Pre-existing revenue coupled with financial projections on future progress is often needed as well.

Another critical component any company pursuing Series A Investors needs is competent management positioning. Smooth operations with strong executive capabilities demonstrate professional preparedness customized to scaling up rapidly with additional operational load related to bigger investments received after successful funding closings.

Series B Funding

Series B Funding typically takes place when a startup has proved itself tendentially successful and is looking to build upon its success and scale further. This type of funding represents the next level for startups in their journey and into greater challenges, such as launching new products or expanding into international markets.

While many traditional venture capital firms become involved in Series B deals, this round also opens up potential participation from companies already operating issue ongoing business, such as corporate giants and some private equity investors.

Key considerations for those seeking out Series B funding is essentially having plans for growth that go beyond incremental increases – these should be achievable and have realizes potential for the investors they are trying to attracted.

Investors involved

When it comes to Series B funding investors typically involve venture capital firms, high net worth individuals, and other strategic investors. Venture capitalists often lead the round in order to get a larger stake making future investments more appealing.

High net worth individuals often make it possible to increase the size of a grand total while adding access individuals/connections that can help increase growth in operational strategies beyond capital. Lastly, there are existing VCs and lenders investing more rounds as expansions to already proven moneymaking products or divisions exist within their businesses.

Key considerations for startups seeking Series B funding

Startups should consider a number of factors when looking for Series B funding. They need to assess internal objectives and realistic goals in order to pitch successfully, and prove that they are equipped with expertise and tools to capitalize on sufficient milestones in the future.

When seeking investors, series B funding applicants should conduct competitive research about potential partners based on their past portfolio success as well as look into innovative improvements they can do within their existing project or business plan while gaining detailed insights from the market.

Series C Funding

Series C funding is a type of fundraising effort that occurs when companies have already gone through Series A and B rounds. This stage often involves venture capital firms or similar large investors who focus on funding Stage C companies, which are usually more mature with potential for exponential growth.

This round of financing can also involve consolidations, acquisitions, IPOs and mergers. The purpose of Series C funding could be to help the company expand its online presence and/or global operations to seek profitability in market spaces not yet tapped into.

Investors involved

Series C funding is typically focused on scaling businesses to the public market. Investor groups in this series often significantly impact companies and common investors involve hedge funds, private equity firms, venture capitalists, and mutual funds.

As investments from Series A to Series C increase exponentially, angel investor involvement decreases due to limits in terms of how much each round annually increases by percentage as mandated by law.

Additionally, contributions are expected at high levels from these professional classes kept abreast of industry ends trends before deciding on which start-ups could exceed their expectations in the long term for profit returns.

Key considerations for startups seeking Series C funding

Key considerations for startups seeking series C funding include strategic and tactical capital deployment. Startups should determine how they can take advantage of larger pools of capital to break into new markets, acquire or partner with the competition, and enhance existing capabilities and products.

Series C investors will expect proven records of success over an extended period, including projects funded by previous investments that met or exceeded expectations.

They want reduced risk because they understand startups first at this stage in their development cycle. As such it is important for startups seeking Series C funding to present the highest possible returns on investment while also projecting convincing growth projections to convince investors in usual markets volatility.

Comparison and Key Differences

Key differences between Series A, B, and C funding

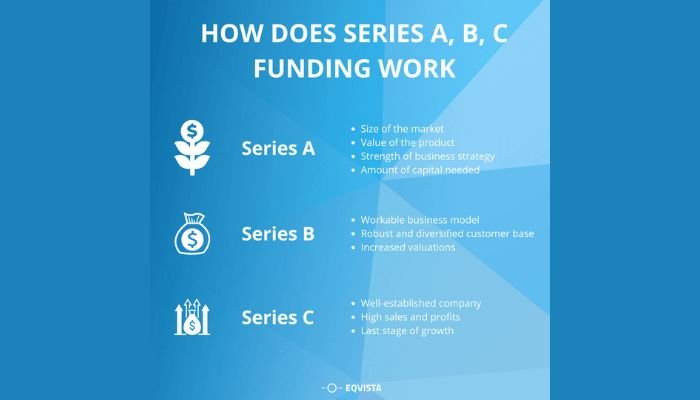

Key differences between Series A, B, and C funding include their purpose, the amount of capital being invested with each round, and the investors involved.

Generally speaking, Series A funding is a more significant milestone which involves an infusion of greater capital from both venture capitalists and private equity as well as initial public offering (IPO) activities.

Series B and C fundraising represent additional infusions of capital that allow companies to achieve certain growth benchmarks or plans prior to fruition. They are often used for scaling businesses in preparation for major milestones including liquidity events such as acquisitions or IPOs.

Funding goals and milestones for each series

Funding goals and milestones for each series vary somewhat depending on the state of the company seeking funding. Generally, a Series A round is set to advance specifically acknowledged procedure steps; minimizing operating expenses and boosting product or service outreach areas.

The main results from a successful Series B round are typically stronger credibility with added growth within target revenue disciplines, either in terms of project increase in certain client departments or marketing pursuits. Acquiring additional resources to bring down problems along with better financial stabilizers themselves sets the course for an expected return on investments during a Series C round.

Conclusion

In conclusion, understanding the basics of Series A, B, and C funding is essential for startup founders. Each series has its own definition, purpose and typical funding range associated with investors involved in each stage.

Considerations such as timing, scalability and valuation of your startup differ at each round of fundraising so that reachable milestones can be established quickly yet incrementally while optimizing capital investments.

As you plan a successful journey forward with your venture’s growth strategy aligned to launching successful products or services in the market for value creation – startups need to navigate wisely through the turbulence orchestrating an enticing sustained facilitation between investor objectives; being key metrics along with proper planning from start up leaders alike.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.