How Buyout Funds work: Comprehensive Overview

Buyout Funds are a type of capital investment fund aimed at acquiring and managing target companies in order to increase their value.

It is an important financial instrument that plays a key role in the financial market, allowing investors to rapidly achieve returns through pooling large amounts of trading activity for more efficient leveraging or diversification.

By providing capital and advising on industry best practices leveraged buyouts enable corporations to execute expansion strategies while raising capital resources without giving up control or enduring excessive debt.

Contents

Understanding Buyout Funds

Definition and Characteristics of Buyout Funds

Buyout funds are investment vehicles that acquire ownership in and provide financing to companies with the expectation of generating a return on investment. Buyouts utilize debt to fund an acquisition, enabling increased returns for investors while making cash flow projections more precise.

The characteristics defining buyout funds include substantial capital commitments over multiple years from numerous institutional and private investors, fees based on investments realized instead of time spent by general partners managing the fund, and focused investing in a limited number of target enterprises or sectors made possible via structured transactions.

Different types of Buyout Funds

1. Leveraged Buyout (LBO) Funds

Leveraged Buyout (LBO) Funds use borrowed capital to acquire a controlling interest and majority stake in a company. This form of financing takes advantage of the high-value gain inherent in private companies and is typically initiated by an external group or investors who identify undervalued or neglected assets and provide financing for an acquisition.

This type of buyout is characterized by the ratio between debt and equity used in finance – with at least half of the capital coming from debt sources as opposed to equity investments.

The potential return on investment far outweighs any associated risk since interests are paid by established revenues from acquired targets instead outside shareholders, involvement from management teams can produce tangible improvement within portfolios over time.

2. Management Buyout (MBO) Funds

Management Buyout (MBO) Funds are a type of buyout fund that generally involves senior managers or key personnel acquiring majority ownership in an existing business they help run.

MBO Funds finance strategies with different types of capital sources like equity, debt, venture capital, and mezzanine funding. These funds provide companies the opportunity to be bought from their current owners without the need to go through a lengthy public offering process or look for new buyers.

MBO Funds can help secure more favorable terms compared to corporate leverage buyouts enabling acquisition teams to control management activities after the change of ownership.

3. Private Equity Buyout Funds

Private Equity Buyout Funds are a type of Buyout Fund that focuses on taking ownership control of portfolio companies, either through majority stakes or complete buyouts. These Funds apply existing capital to make investments in private businesses to grow and increase value through operational enhancements.

They leverage private equity financing in the process, often including mezzanine debt, senior debt or leverage buyouts in their deals. Private Equity Buyout Funds provide the resources and expertise necessary to identify distressed, undervalued companies and properly endeavor highly-regulated transactions to acquire them.

Once acquired, these Funds look for strategic initiatives and growth opportunities within each portfolio company while seeking exit strategies such as IPOs or outright sales at optimal valuations upon realizing gains from holding periods.

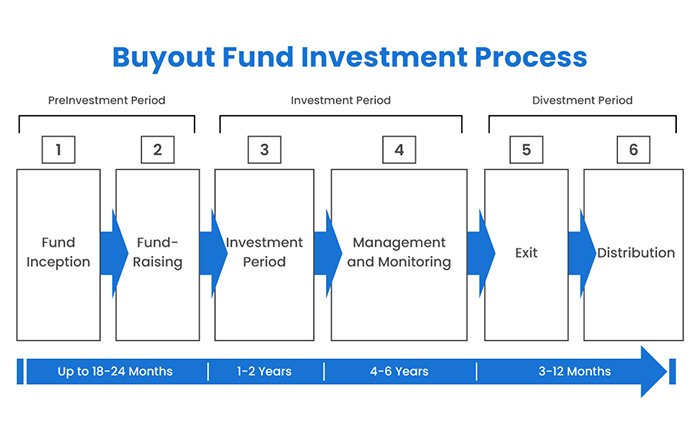

How Buyout Funds Work

Fundraising and capital acquisition

1. Limited Partners (LPs)

Limited Partners (LPs) are investors that provide the primary source of capital for buyout funds. They commit a pooled amount of money to the fund and can include pension funds, endowments, financial institutions, family offices, and high net-worth individuals.

The fund will establish legal documents such as side letters depending on the size and nature of the investment with LPs in order to ensure transparency agreement and historical records. In return for their investments, LP will need to give up some management or decision-making rights over to the GP while still having passive opportunities ensuring certain Fund operational standards.

2. General Partners (GPs)

General Partners (GPs) are typically experienced and qualified fund managers appointed by the buyout fund to serve as representatives of limited partners in the management of their pooled capital.

They play a complex role in fundraising and capital acquisition for the fund, leveraging their network, identifying targets, approaching potential limited partners, pitching investors, leading due diligence on potential investments, and structuring transactions.

The immense responsibility both increases returns while avoiding risks hinges heavily upon GPs leveraging their skillset and industry knowledge. Consequently, it’s common practice for LPs to frequently conduct due diligence against GP as part of assessment scores during onboarding phases which contain penalties for any pressing issues regarding trust or financial reward splitting models associated with equity offers.

Investment strategy and target companies

1. Identifying potential investment opportunities

The investment strategy employed by buyout funds principally focuses on identifying potential target companies that are undervalued or underperforming.

It involves analyzing financial statement information, performing market research, conducting competitor analysis, and other due diligence activities to evaluate opportunities for growth and value creation.

Through an in-depth assessment of the underlying company’s management team and competitive landscape, buyout funds are able to identify mispriced acquisitions or investments.

2. Conducting due diligence and risk assessment

Conducting due diligence and risk assessment is an essential part of a buyout fund’s investment strategy.

Before making a commitment to acquire a company, fund managers evaluate all factors associated with the potential target, including financial performance, management team, market plant expansion opportunities, and competitive advantages.

Through expansive research and qualitative and quantitative analysis, they assess whether or not an acquisition makes economic sense from both short-term and long-term perspectives.

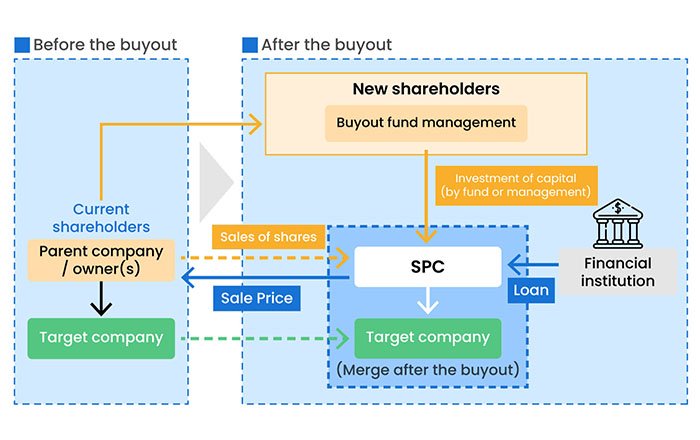

Acquiring target companies

1. Negotiating deals and structuring transactions

Negotiating deals and structuring transactions are two fundamental steps in acquiring target companies for buyout funds. GPs have to undertake negotiations with the potential sellers and agree upon the terms desired in accordance to value creation, minimalizing risks, and maximizing returns for the deal.

Once both parties have agreed on a deal performance structure, GPs need to ensure necessary steps are taken as deemed externally needed (i.e., compliance issues). This consists of determining an appropriate pricing strategy involving financial instruments that correspond with tax policies across relevant jurisdictions while meeting the fiduciary protocols of being an investment manager/advisor who abides by applicable legislation.

2. Financing the acquisition

Financing the acquisition is an integral part of the buyout fund process. A variety of debt and equity instruments are typically utilized in order to finance the acquisition.

This can include a combination of bank loans, bonds or notes issued via public offerings, mezzanine funding, as well as institutional financing from sources such as pension funds or insurance companies.

Usually, a leverage ratio is to be maintained for safety purposes and lenders will want to ensure that there is sufficient cash flow within the target company so they can get paid off over time.

Post-acquisition management and value creation

1. Implementing operational improvements

Once acquired, new processes may need to be put in place or existing ones improved. This can involve introducing modern technologies, expanding infrastructure, adjusting production techniques, changing supply chain operations, monitoring quality control standards, and restructuring debt obligations among many others.

By optimizing these aspects and addressing underlying issues at the target companies such as marketing effectiveness or overhead costs of unnecessary employees buyout funds aim to improve efficiencies that generate a rapid return on investments and capture new growth opportunities ahead of competitors.

2. Enhancing the target company’s performance

Post-acquisition management and value creation involve activities to improve the target company’s profitability, performance, and strategic position. Once acquired by a buyout fund, efforts are made to enhance the target company’s bottom line performance with improvements such as cost containment initiatives or tapping new markets/products.

Personnel management seeks alignment of incentives between management teams and internal staff motivating employees towards common organizational goals. Potentially divergent interests often through jointly owned subsidiaries can be directed toward one corporate purpose.

Conclusion

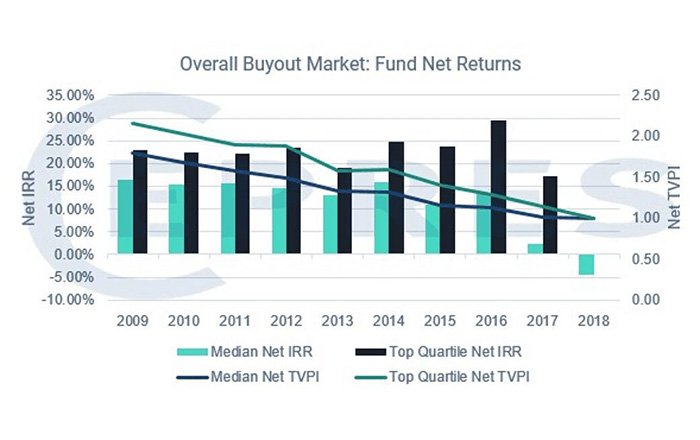

Buyout Funds are an important type of capital investment vehicle in the markets and offer lucrative returns to investors.

They offer competitive advantages over traditional investing strategies due to the ability to complete transactions with speed, take leveraged positions, or acquire entire companies.

Buyout Funds also come with certain risks; if not managed properly, they can lead to harmed reputation, lost funds, reduced performance from target firms, or miss out on potentially profitable opportunities.

Despite recent temporary market fluctuations, due to decreased investor sentiment and valuation concerns tracking valuations along with careful portfolio assessment offers potential for future buyout success.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.