Venture Debt: In-Depth Guide to Venture Debt Financing

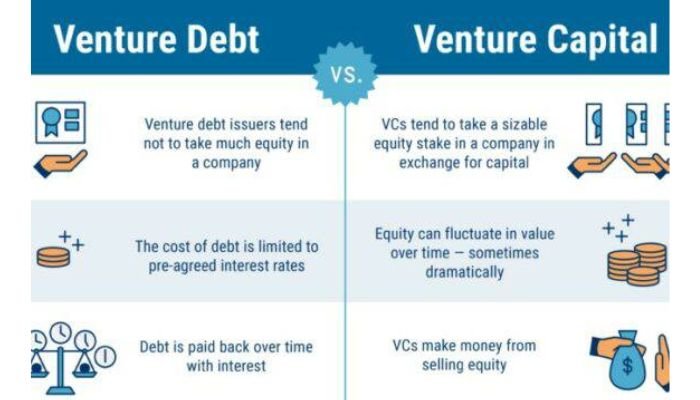

Venture debt financing is an alternative form of funding for startups and growth-stage companies that does not involve a dilution in equity ownership. It typically requires less paperwork than traditional or bank loans and can be more flexible, especially during the early stages when revenue streams are still uncertain.

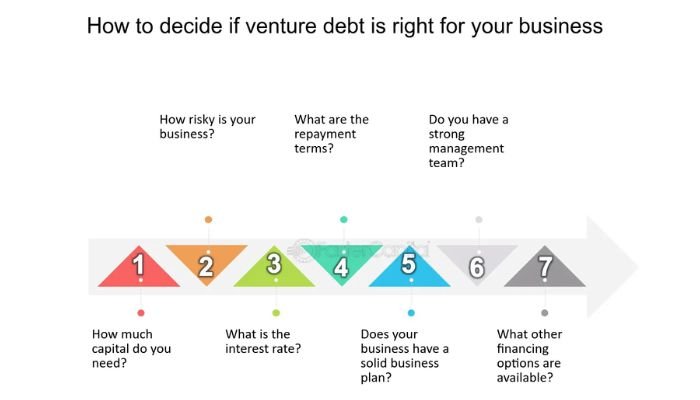

However, it also carries its own unique terms, costs, risks and strategies that must be carefully considered before pursuing venture debt as part of your overall capital stack strategy.

This guide provides an overview of everything you need to know about venture debt financing—from defining key principles such as players involved in this type of transaction (venture lender vs investor), characteristics related to structure & repayment considerations (debt structure & security requirements) through understanding pros/cons associated with taking on additional expenses but gaining non-dilutive income sources.

Contents

Understanding Venture Debt Financing

Key Players in Venture Debt Financing

1. Venture Debt Lenders

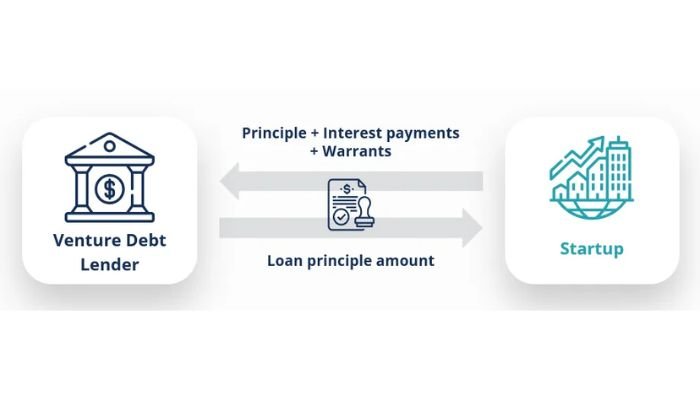

Venture debt lenders are an essential part of the venture debt financing process, as they provide capital and other resources to startups or growth-stage companies.

These specialized financial institutions will review a business plan and due diligence materials before providing their tailored loan packages – typically with higher rates than traditional loans but potentially more flexible terms.

They may also add warrant coverage or equity kickers in order to increase returns on investment should startup successfully secure future rounds of funding from VCs. Moreover, these lenders can offer non-dilutive options that help preserve company ownership ratios for founders down the line.

2. Venture Capital Firms

Venture Capital Firms are key players in venture debt financing, often acting as an intermediary between the startup and loan originator.

They offer financial advice to startups considering a venture debt facility, promising capital for future rounds of funding.

Venture firms can also provide guidance on term sheet negotiation; protective covenants; dilution considerations from warrants or equity kickers tied to loans.

Ultimately they guide entrepreneurs through their decision-making process when it comes to choosing how much traditional equity vs non-dilutive financing best serves their company’s needs over time – balancing sufficient cash reserves with control of ownership structure and governance rights being critical factors moving forward.

3. Startups and Growth-stage Companies

Startups may use it for early seed funding while more mature, growing businesses often leverage this type of lending to extend cash reserves or stimulate further product expansion without waiting on traditional investment returns from investors.

However, these types of financial arrangements aren’t suitable for all circumstances; startups should consider their plans surrounding equity versus debt before embarking upon any form aggressive fundraising effort involving venture lenders.

Characteristics of Venture Debt

1. Debt Structure and Terms

Debt structure and terms are one of the key characteristics to consider when exploring venture debt financing. It range from term loans, revolver facilities or flexible lines of credit depending on a company’s financial goals and situation.

Terms vary based on factors like the potential return for lenders and repayment history; they may include conditions such as interest rate, draw down periods/maturity dates, capitalized versus uncapitalized fees (if applicable), penalty rates due to late payments or defaults plus any equity kickers that might be included in lieu of cash repayments.

2. Collateral and Security

Collateral and security are important characteristics of venture debt financing. Venture lenders usually require at least some form of collateral for their loan, typically in the form of tangible assets such as property or inventory, or intangible assets like customer contracts and intellectual property rights.

Depending on the structure and size of a loan, it is also possible to secure an agreement with personal guarantees from founders/shareholders. In distressed cases where traditional credit criteria cannot be met by startups/growth companies seeking venture debt finance, warrants can sometimes be used instead if additional equity cushion would make pre-payment more likely upon exit events.

3. Warrants and Equity Kickers

Warrants are options provided to the venture debt lenders that allow them to purchase equity at a predetermined price. These provide additional protection for lenders, as they can take part in any future proceeds from an exit or sale of the company should it occur.

Equity kickers on the other hand give venture debt holders more direct control over their investment; these entitle them to receive additional shares if certain performance milestones and key business goals are achieved by borrowers.

Differences between Venture Debt and Traditional Debt

Venture debt is a form of financing available to startups and growth-stage companies that are unable to access traditional bank loans. While venture debt may appear similar, there are key differences between the two types of financing.

Venture debt typically does not require personal guarantees or collateral beyond ownership equity in the company, has shorter terms than traditional loans (e.g., 1–2 years versus 3–7 years), requires periodic updates from borrowers on their performance against milestones set out by lenders at closing and includes equity kickers where the interest can be converted into shares upon repayment.

Additionally, unlike traditional business loan repayments which involve principal plus interest payments each month over several quarters/years before the balance reaches zero; venture debts offer more flexibility that allows for lump sum payment when cash flow permits it without any penalty charges as long as the Payback period matures.

Finally — while both strategies must take risk into account — safe investments generally come with lower returns whereas higher yields associated with venture debt products justify the lender’s perceived level of risk.

Pros and Cons of Venture Debt Financing

Advantages of Venture Debt Financing

1. Preserving Equity Ownership

Venture debt financing is an excellent way to access non-dilutive capital while preserving equity ownership. The primary advantage of venture debt compared to traditional investments such as angel or VC rounds, is that the entrepreneur’s current proportion of ownership in the company remains unchanged after completing a venture loan agreement.

This means founders and early employees retain higher levels of control over their projects without sacrificing financial returns on investment. On the other hand, some disadvantages include increased interest costs and greater risk due to lack of collateral or security for lenders if repaid late/defaulted upon – thus cash flow management must be carefully monitored during repayment plan periods.

2. Access to Non-dilutive Capital

Venture Debt Financing provides access to non-dilutive capital, which can help startups and growth-stage companies maintain their equity ownership. The immediate benefit of this is that it allows the company’s founders or investors to keep a greater amount of control in how their businesses operate without having to give up any equity during financing rounds.

Additionally, venture debt does not require fundraising for repayment as traditional debt would; however, interest rates are typically more expensive than other loan types, therefore, resulting in higher costs associated with taking on such debts.

3. Enhanced Investor Credibility

Venture debt financing can be an attractive option for startups, particularly due to its advantage of increased investor credibility. Credibility from venture debt lenders adds value when pitching investors and banks for future investments or loans– demonstrating that hurdles such as capital requirements are not too complex for the company.

Additionally, it also speaks favorably about a startup’s potential performance in the eyes of outside profit-oriented entities looking at top-line revenue growth; lower failure rates; internal development capabilities; customer confidence in product/service reliability among other factors.

However, this does come with some disadvantages including higher costs than traditional equity financing along with more complicated financial risk assessment measures by outsiders worth considering before deciding on whether or not to pursue venture debt finance as part of your funding strategy.

4. Flexibility in Repayment

The primary benefit of venture debt financing is the flexibility in repayment. As some startups are unable to make payments on time, this provides them with a way out without severely impacting their balance sheets or triggering investor agreement clauses.

Investors also have more control over loan terms and can structure debt according to specific needs allowing for a customized approach that is beneficial for both borrower and lender alike Another pro here when using venture debt funding instead of equity; it gives companies an opportunity to preserve small business ownership percentage as well providing prospects beyond fundraising options like IPOs & acquisitions.

Disadvantages and Risks of Venture Debt Financing

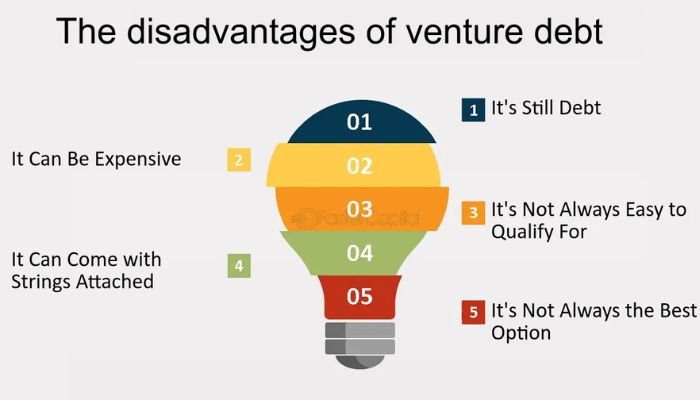

1. Higher Interest Rates and Costs

Venture Debt Financing can come with a number of risks, including higher interest rates and costs. Although Venture Debt has more flexible terms compared to traditional debt financing, lenders will usually charge startups and growth-stage companies significantly higher interest than what is charged for corporate loans or other forms of business borrowing.

This increase in cost makes it critical for founders to fully understand the repayment parameters before taking on any loan obligations so that they know exactly how much the additional financial burden could be over time if certain conditions are not met.

2. Increased Financial Risk

Venture debt financing raises the financial risk of a company due to its inherently higher interest rates and larger loan amounts when compared with traditional debt.

Companies should approach venture debt carefully as these terms may require collateral, resulting in further dilution for current shareholders if repayment deadlines are not met.

Additionally, accumulating more venture capital at an early stage can be detrimental down the road if companies do not reach profitability goals or struggle to raise their subsequent rounds based on heavy earlier investment from lenders.

3. Impact on Future Financing Rounds

Venture debt financing can come with many risks. One of these is the potential impact on future rounds of financing if investors view large amounts of venture debt as a red flag or an indication that the startup may be struggling financially.

This means that startups must carefully manage their borrowing and structure any loan terms to ensure they will not affect future investments from equity-based sources, such as private financiers and angel investors. Otherwise, it could hamper access to capital going forward down the line.

Strategies for Successful Venture Debt Financing

1. Building Relationships with Venture Debt Lenders

Successful venture debt financing relies heavily on relationships. It is important to build trust with lenders and show that you are the right fit for their type of venture debt product.

The best way to do this is by having an experienced financial advisor or CFO who can speak in detail about your current operations, have a comprehensive business plan outlining future growth opportunities, and demonstrate access potential from multiple sources (such as investors).

They will also be able to negotiate terms and ensure open communication between both parties throughout the journey toward securing loan approval.

Overall, relationships hold great influence over success rates when it comes to Venture Debt Financing; hence strong relationship building should always come first before attempting any funding activities.

2. Mitigating Risk and Ensuring Financial Health

Mitigating risk and ensuring financial health are essential when applying for venture debt financing. Startups must have a clear understanding of their cash flow, repayment period preference/capability as well as an evaluation of the likelihood that it will be able to meet its debt servicing obligations with future funding rounds.

Companies should carefully consider how much money they need versus what can realistically be provided by investors or lenders gave current market conditions supplemented with realistic expectations regarding growth potential over time – all while avoiding overextending themselves financially.

3. Utilizing Venture Debt alongside Equity Financing

Utilizing venture debt alongside equity financing is an effective way to maximize the financial benefits of both types of capital. When deployed in combination, each form can be tailored and utilized to add value while minimizing risk by strategically addressing specific needs.

Equity funding provides a valuable injection of growth finance at important milestones along the journey, while flexible higher-yield debt financing helps extend cash flows further until those objectives are reached or when circumstances require resources more quickly from other sources than traditional investor rounds allow for.

Careful consideration should always be given as to how much venture debt will work best within your unique business situation before taking it on board.

4. Managing Cash Flow and Loan Repayments

Managing cash flow and loan repayments is an essential part of any venture debt financing strategy to ensure successful repayment. Companies must consider the timing of investments, expenses, as well as sales and other revenue streams when preparing a budget capacity assessment for future months.

This helps lenders assess operational performance metrics such as outstanding receivables before approving a loan or extending terms on existing ones. Additionally, companies must observe contracted due dates in order to stay compliant with their agreements or else risk missed payments which could damage credit scores over time.

Conclusion

In conclusion, venture debt financing can be a powerful tool for startups and growth-stage companies looking to access non-dilutive capital with flexible repayment terms.

By building relationships with lenders, mitigating risk through financial health strategies, utilizing both equity and debt funding together effectively, and managing cash flow appropriately during loan repayments; founders have the potential to benefit from increased investor credibility in an overall more efficient fundraising process.

Ultimately it is important for entrepreneurs considering this type of financing to understand all aspects so that they can make informed decisions about the best route forward for their business’s success.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.