Private Equity vs. Strategic Buyers: Which Exit Strategy is Best?

Exiting a business isn’t just about signing on the dotted line and sipping cocktails on a private beach—though that’s certainly a perk if you pick the right partner. The choice between selling to a Private Equity (PE) firm or a Strategic Buyer can shape everything from deal structure to your future day-to-day involvement (or lack thereof).

This piece isn’t for M&A newbies; it’s a deep dive into the complexities of each route. We’ll dissect the interplay of capital structures, valuations, corporate culture integrations (or collisions), and negotiation showdowns, all with a healthy dash of cynicism.

Contents

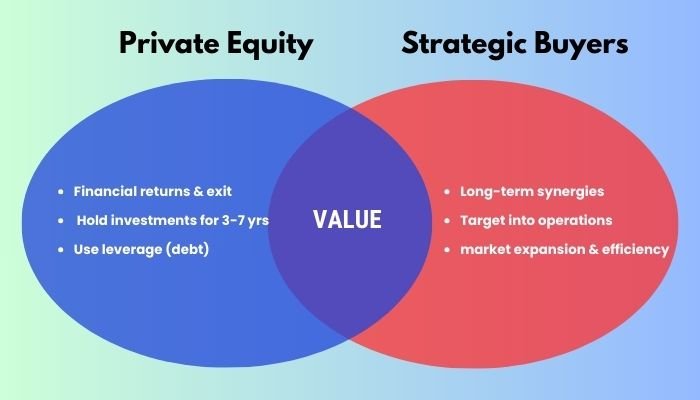

Private Equity vs. Strategic Buyers: The Fundamental Distinctions

Investment Thesis & Motivations

- Private Equity: PE firms typically operate on a shorter to mid-term horizon—think 3 to 7 years. They’ll pepper that timeline with IRR calculations, leveraged buyouts (LBOs), and an almost romantic obsession with efficient capital structures. It’s all about multiples and exit plans (secondary sale, IPO, or flipping to another strategic). If you enjoy living under the tyranny of monthly board calls scrutinizing every possible KPI, PE might be your jam.

- Strategic Buyers: These corporate behemoths (or midsize opportunists) are often in it for the long haul. Their main drivers: synergy opportunities, expansion of product lines, or scooping up new technologies so they can dominate even more of the market. If the concept of “integration synergy” sparks your excitement—or your nightmares—this is where strategic buyers shine.

Capital Structure

- Private Equity: The typical PE approach is to load the balance sheet with debt (as much as the bankers will tolerate), then attempt to juice returns via operational improvements—or so the investment committee deck claims. Covenant negotiations can feel like signing your soul away to a consortium of lenders.

- Strategic Buyers: They usually have deeper corporate coffers and can deploy excess capital without as much reliance on debt. They can pay a premium when they really like your IP, brand loyalty, or revenue synergies—just don’t ask them to define “synergy” without a deck.

Control & Governance

- Private Equity: The firm buys a majority stake, slaps a few of their “operating partners” or “independent directors” on your board, and expects you to play nicely with their Excel jockeys.

- Strategic Buyers: Once the ink dries, your management structure may get absorbed into the bigger corporate entity. Or, if you’re lucky, they’ll let you run semi-autonomously—until the next reorg, at least.

The Due Diligence Labyrinth: Financial, Operational, and Cultural Angles

Financial Scrutiny

- Both buyer types will slice and dice your financials, but PE’s approach can be particularly forensic. Prepare for quality of earnings (QoE) reviews that will unearth every skeleton in your ledger. That “miscellaneous expense” line item you’ve been ignoring will get the third degree.

- Strategic buyers also care about financial health, but they’re equally keen on synergy potential (read: “We can cut your overhead by merging with ours.”). They still want to see bulletproof statements—just expect a heavier focus on top-line and cross-selling potential.

Operational & Tech Stack Audits

- Private Equity: They’ll clock your production line with a stopwatch if it means optimizing EBITDA. If you have any inefficiencies, prepare for a “transformational project” (AKA cost cutting) on day one.

- Strategic Buyers: They’re scanning for how your operations will integrate with their existing infrastructure—CRM systems, supply chain, product roadmaps. If your tech stack is outdated, they’ll likely plan a complete overhaul, with consultants generating slides about synergy for months.

Cultural Compatibility or the Lack Thereof

- Private Equity: They generally won’t meddle in the daily culture unless it’s hurting performance. “Keep the brand identity, but please triple your margins,” sums up the approach.

- Strategic Buyers: Corporate assimilation can be swift and merciless. Everything from your HR policies to your morning coffee brand might shift. Cultural mismatch can lead to a mass exodus of talent if not handled delicately.

Valuation Methodologies

- Discounted Cash Flow (DCF): Everyone’s favorite exercise in forecasting the future (and more often than not, painting it rosier than reality).

- LBO Models: A staple in PE. The real question is: how much debt can we slap on this thing and still have a positive IRR? It’s a delicate dance of leverage ratios, interest coverage, and ensuring you’re not the next cautionary tale.

- Synergy-Driven Multiples: Strategic buyers love citing synergies to justify paying a higher multiple. This is great—assuming those synergies materialize before the next fiscal year’s budget cuts.

Earnouts, Escrows, & Other Thrilling Negotiation Tactics

- Earnouts: The magical bridging tool between your lofty valuation expectations and the buyer’s cold logic. PE firms might use them to ensure performance targets are met. Strategics may prefer earnouts when synergy predictions are, ahem, optimistic.

- Escrows: Because no buyer wants to chase a seller post-closing if your “hidden liabilities” suddenly surface. Escrows are basically insurance that the seller can’t vanish with all the money before the compliance folks show up.

Equity Rollover & Founder Incentives

- Private Equity: Often dangles co-investment and rollover equity to keep you around and motivated. (Nothing says “We value you” like signing a new vesting schedule, right?)

- Strategic Buyers: They might opt for retention packages or corporate stock options. The catch? You’ll need to navigate the labyrinth of corporate performance reviews and potential reorgs every quarter.

Post-Transaction Realities: Integration vs. Autonomy

Strategic Integration

When a strategic buyer acquires you, prepare for integration committees, synergy workstreams, and an unending parade of memos about “alignment.” In the best scenarios, you’ll merge seamlessly—sharing resources, cross-selling, and capturing new markets together. In the worst, you’ll watch your product lines and teams get swallowed into a giant corporate machine until your brand is just a footnote.

Private Equity Autonomy

PE firms often adopt a “hands-on, but not that hands-on” approach. Expect them to be laser-focused on key performance metrics, but beyond that, they may leave day-to-day decisions to the executives (as long as the numbers are up and to the right). Tread carefully if you miss a quarter or two; the leash can tighten rapidly.

Exit Timelines and Secondary Exits

- Private Equity: They live for the exit. In 3 to 7 years—maybe sooner if the market’s on fire—they’ll look for a buyer (possibly another PE) or push you toward an IPO if your growth is sexy enough for the public markets.

- Strategic Buyers: Theoretically, you integrate and stay integrated… until your new corporate overlords decide you’re no longer essential to their grand plan. That can trigger carve-outs, spin-offs, or other M&A amusements.

Decision Criteria & Parting Shots

Risk Appetite and Growth Trajectory

If you want to push rapid growth, optimize operations, and exit again in a few years, PE might be your golden ticket. If you crave stable long-term investment and a cozy fit into a larger corporate empire, a strategic sale is more your speed.

Fit With Company DNA

Does your brand thrive on entrepreneurial freedom, or could it benefit from a juggernaut’s distribution channels? Remember: synergy can be magical—or it can smother the very aspects that made your company unique.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.