Financial Bear Hugs: Definition, Causes, and Implications

Financial bear hugs are a technique used within finance to manipulate the stock market and move prices in a particular direction. Familiarizing oneself with the knowledge of bear hugs in finance is increasingly important, especially during times such as now when investors are looking for alternate methods of making profits besides traditional investments.

In this blog, we’ll discuss how bear markets occur and identify certain causes and effects associated with them, explain what mechanisms are traditionally employed to initiate a bear hug (such as short positions and misinformation), analyze strategies for mitigating the negative impacts they have in more detail while discussing implications from legal and ethical perspectives.

Ultimately, the goal is to educate students about this unique manipulative tactic within financial markets while exploring ways available for curbing their detrimental impact.

Contents

Understanding the Bear Hug Phenomenon

A bear market occurs when a wide swathe of asset prices across stocks and bonds fall by at least 20% over an extended period of time. It’s usually accompanied by news stories corresponding to financial uncertainty, unemployment spikes, geopolitical risks, or pandemics.

These conditions create a lack of investor confidence and dampen economic activity. During this period, stock prices tend to be highly volatile as traders attempt to find the floor for the price while navigating global news swings related to valuations, risk premiums, and pandemic effects challenges from multiple sectors.

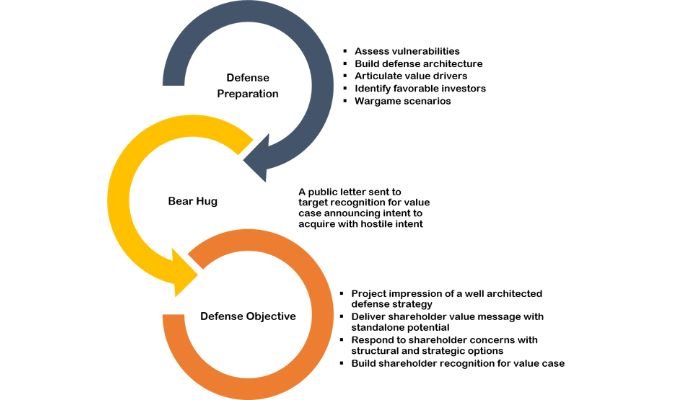

Concept of a bear hug in finance

The concept of a bear hug in finance is one manipulation tactic employed by large institutional investors and traders to influence stock prices.

A bear hug involves accumulating short positions, with the concerted goal of driving down the market price, or depressing overall market sentiment through disseminating negative news which triggers panic selling from other traders.

While broadly similar to tactics such as share ramping, rumor-mongering, or violating negligence regulations, a bear hug typically involves manifest elements of strategy and firm action beyond rumors encouraged inadvertently by malpractice.

Comparison with other market manipulation tactics

Bear hug in finance compared to other tactics of market manipulation. Bear hugs are a kind of market manipulation most often used by large investors or institutions to exercise control in the stock markets, driving prices up or down and triggering panic selling.

This tactic is significantly different from tactics such as front running and pump and dumps intended to benefit one trader only, instead bear hugs have an overall effect on the entire market.

Its widespread effects make it especially hard to combat given the difficulties produced during the investigation and prolonged deadlines for effective intervention in order to regulate behaviors that can alter future prices.

While its illicit nature makes this type of activity difficult to monitor without strong enforcement mechanisms, understanding these strategies is essential if regulators expect to compete on any level with organized practices like the bear hug phenomenon.

Causes of Financial Bear Hugs

1. Market manipulation by large investors or institutions

Large investors with deep pockets have routinely manipulated markets by engaging in financial bear hugs. Essentially, by strategically accumulating buying or selling positions of large volumes of stocks, such investors disrupt stock movements and aggress the supporters or torch the opponents amid fears of shareholder losses.

Moreover, since these players can control decisions regarding directorships and management roles in companies merely through sheer ownership size, they can potentially use their influence to achieve their end goals too.

Therefore, it is important that regulatory measures be taken up to ensure market fairness and transparency against this form of market manipulation to protect shareholders’ interests from illiquid investments.

2. Strategic short-selling

Strategic short-selling is a common tactic used by bear huggers and can be seen as an attempt to destabilize the market. Short selling occurs when an investor sells borrowed shares options from stockbrokers in anticipation of a price drop, allowing them at then buy it back cheaper later.

By exploiting drops in the value and leveraging numerous positions, or pools of capital, increasing pressure on prices to fall further. This form of violent speculation is relatively simple however carries major ramifications for the market such as drastically swaying market sentiment in lockstep with their tactics.

It can also reinforce market and knee-jerk behavior as unsophisticated investors look to what investors actin in riskless situations despite carrying a fair bit of financial risk.

3. Spreading negative rumors or misinformation

One tactic used in a financial bear hug is spreading negative rumors or misinformation about a particular stock. This can be done by unofficial rumors, juicy gossip, market manipulation tactics, coordinated pressuring of shares among stakeholders, and strategic short-selling activities.

Such methods involve lower-level investors who are not part of the broader higher-power institutions and are able to create fear among unsuspecting traders.

When the misconception-fueled sentiment spreads through uncontrolled channels to trigger panic selling those smaller participants with dimmer expertise benefit from massive profit-making opportunities in a relatively short time frame with little risks compared to full traditional investing games.

4. Coordinated selling by market participants

Coordinated selling by market participants can contribute to the formation of a financial bear hug. A coordinated approach, involving multiple investors, firms, and institutions participating in the same pattern of market activity can amplify sales pressure on a security.

Those parties could have alliance ties through management roles, commercial connections or other institutional relationships that look to collectively turn the tides against certain securities.

It is difficult for regulations to identify yet alone prevent these activities from taking hold, and thus provide sharp setbacks for target assets in highly concentrated areas. Though proactive measures related ones level investing education are seen as the most effective approach in addressing this phenomenon.

Mechanisms and Tactics of Financial Bear Hugs

1. Accumulating short positions

One of the most common tactics for Financial Bear Hugs is to accumulate short positions. This involves buying and selling contracts to exclusively borrow and sell stocks, usually without its owner’s knowledge. In doing so, they are able to drive down prices by flooding the market with stock that must be sold at a loss.

This strategy sends shockwaves through the industry by making investors question their own holdings – resulting in rapid share price declines and crash market conditions on an overall basis.

Attention must also be paid more specifically too as this targeted manipulation can have large impacts across specific funds or liquid trading securities as well.

Responsible management around these sorts of mechanisms is imperative if corporate strategies governing existing partakers’ securities portfolios are going to remain reliable amongst volatility inspiring drastic intervention.

2. Disseminating negative news or rumors

One of the tactics that can be employed as part of a bear hug strategy in finance is to deliberately spread negative news or rumors. This means disseminating information about a publicly traded company with the intention to lower its price and make it risky for potential investors – often driven by vested interest or self-interest.

The goal is to fuel investor fear, create panic selling and consequently drive down prices and increase one’s own returns on investment. Often, these rumors are coordinated with market participants who also take short positions seeking higher profits when the stock eventually bottoms out.

Such behavior clearly shows unethical business practices while inviting further investor cynicism towards securities markets and also impacts governed asset allocations adversely if not curtailed suitably in time by appropriate measures from regulatory watchdog bodies.

3. Coordinated selling to trigger panic selling

Coordinated selling can be used as a tactic by large investors and institutions to launch financial bear hugs. This involves arranging and carrying out large simultaneous sell orders in order to generate enough market pressure on the stock price that brings about panic selling from other participants.

As such, this creates significant downward pressure across the whole market or at least those stocks targeted for bear hugging.

Coordinated sales with similar characteristics can also be difficult to differentiate from non-intentional brokers’ practices; often they slip through existing regulatory frameworks unnoticed or unpunished.

Nevertheless, well-timed insider selling-related events combined with massive trading operations still pose genuine risks and must not be underestimated by any regulator.

4. Exploiting regulatory loopholes or weaknesses

Exploiting regulatory loopholes or weaknesses can create an environment that allows for financial bear hugs. Through this tactic, larger and more influential investors can gain advantages over smaller and less powerful ones, often forcing companies into a corner from which there is no easy exit.

This could involve utilizing shady tactics such as coordinating outside transactions with in-house trades or engaging in insider trading, which both take advantage of existing regulations to secure profits.

Additionally, market participants may exploit the speed imposed by regulations when entering positions with short-selling bids to manipulate prices and gain a competitive edge over weaker competitors.

By doing so they can ultimately suppress former shareholders’ confidence far beyond where it truly should stand based on solid fundamentals.

Implications and Effects of Financial Bear Hugs

1. Impact on stock prices and market volatility

Financial bear hugs have an important impact on stock prices and market volatility. Stock prices generally decrease quickly when a financial bear hug occurs, as large investors accumulate short positions or spread negative rumors.

This could cause rapid drops in the value of securities and trigger panic selling by small investors. The intense levels of market insecurity can also lead to high risks and cause intensive price fluctuations which drastically affect overall market stability, liquidity, and efficiency due to lack of investor confidence.

All these impacts further contribute to increasing volatility in markets which highlights the need for sophisticated risk management measures to be put in place.

2. Effects on corporate reputation and financial stability

bear hugs can have significant negative implications and effects on corporates’ reputations and financial stability due to the sharp drops in stock prices that they may cause. This damage brings a great deal of uncertainty not only for company executives but also employees of companies affected by bear hugs.

Further disruption stems from slowing economic activity as investors become hesitant to resume investment until regulatory interventions have taken place. Regulatory responses may include suspensions, market freezes, or investigations that further complicate losses which take immense amounts of time to recover from both economically and reputationally.

To manage reputation loss, it is critical for businesses affected by a bear hug event to mitigate public perceptions quickly and provide sufficient moral reassurance through transparency so stakeholders remain confident in managing risks within their portfolios.

3. Regulatory responses and market safeguards

Regulatory responses to financial bear hugs vary by jurisdiction, but generally include greater monitoring of insider trading; added civil and criminal sanctions against market manipulation; and attempts to require transparent disclosures regarding the issuance of reportable trades as well as potential partnerships in coordinating sales actionable trades.

Market safeguards take a variety of forms, such as oversight roles with greater power granted to regulating authorities, increased probes into suspicious activities related to asset trading, and permanent circuit breakers protecting investors from wild swings in prices triggered by excessive speculation or other market manipulations.

Timely commitment is also key for effective regulation enforcement — implementing retroactive mandates can only be useful if they target time-bound objectives during identified windows wherein prohibited behaviors are likely to occur again.

Conclusion

In conclusion, financial bear hugs involve the intentional driving down of stock prices through bear market manipulation. By understanding that institutional investors or short sellers can use tactics such as spreading negative rumors and coordinated selling, it is crucial for both regulators and investors to practice increased vigilance when it comes to bear hugs.

Regulatory responses can then be put in place more quickly and potential damage minimized. To reduce the probability of further incidents occurring, companies need to demonstrate financial transparency leading toward better investor understanding.

It is only with a thorough appreciation of the threats posed by bear hugs combined with proactive preventative measures that we will fully safeguard global markets.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.