Differentiating Public and Private M&A Deals

Mergers and Acquisitions (M&A) is a type of corporate financial deal that allow two different companies, or a company and another entity, to combine or transfer ownership. Because each M&A transaction is unique in its structure, terms, and conditions it’s necessary to understand the differences between those deals that are accomplished within public companies and private ones.

Being mindful of the distinctions between these two types of transactions can be the difference between securing advantages for buyers or sellers, as well as mitigating risk during consideration of potential merger opportunities.

This blog explores how various patterns emerge when contrasting public with private M&A transactions. By focusing on certain features associated with both cohorts like regulatory requirements and access to information we can compare Mergers and Acquisitions to trace the lines of demarcation. All in all, this article shed light on the prominent factors at play in addressing the nuanced differences between public and private transactions.

Contents

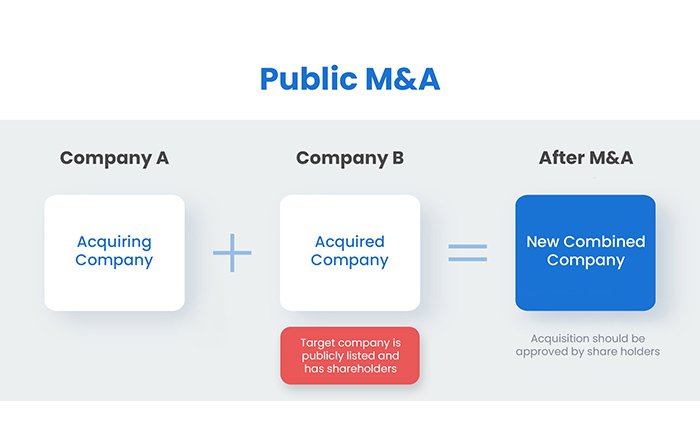

Public M&A Deals

Public M&A deals involve publicly traded companies that have issued shares, debt, or another investment instrument to sell to the public. This type of company is regulated by laws and disclosure requirements from governments or stock exchanges at national or international levels.

Public companies are those subject to the periodic filing and/or public dissemination of information regarding their operating performance, financial review, and other pertinent data as governed by securities legislation.

The primary feature distinguishing public M&A transactions from private ones has to do with their impact on current shareholders – namely, they must approve any sale-related purchase through votes taken at an annual general meeting (AGM).

Key features of public M&A transactions

1. Regulatory requirements and disclosures

Public M&A transactions are subject to strict regulatory requirements that govern the entire process from start to finish.

These regulations include disclosure of all material information required under applicable securities disclosure laws and agreements among buyer and seller companies.

All parties involved may also be required to make public filings with relevant stock exchanges, and government regulatory bodies, as well as seek shareholder approval for certain aspects of the transaction, such as consideration/pricing terms or unfavorable conditions for existing shareholders.

Public M&A transactions usually involve shareholders of public companies, in addition to the relevant corporate officers. The main role that shareholders usually need to play is approval for the merger or sale– this typically requires shareholders’ meeting on each side where necessary changes are proposed and voted upon before a transaction is final.

In accordance with applicable stock exchange rules, all parties involved should also provide notice about material developments related to an announced deal through stock exchange filings. During mergers between publicly listed companies, experts may even need to be appointed by either party in order to assist and supervise stakeholders when opting for a reconciliation process in terms of capital changes abilities as negotiated during deals.

Advantages and challenges of public M&A deals

The advantages of public M&A deals include access to large capital pools for organizational growth and the disclosure requirements potentially attracting interested buyers. The process of getting a deal approved by the regulator also provides significant protection from any market movements impacting the proposed transaction terms.

Another plus is that shareholders approve the sale allowing a bargain on beneficial terms for both parties. On the downside, complying with SEC disclosures can be laborious and time-consuming while unpredictable sentiments of public markets might lead to delays or disagreements regarding prices offered.

In addition, investors have greater legal rights than competitors in regards challenge-Mergers & Acquisition activities which can increase scrutiny claims and lift any risks associated with pending verification processes.

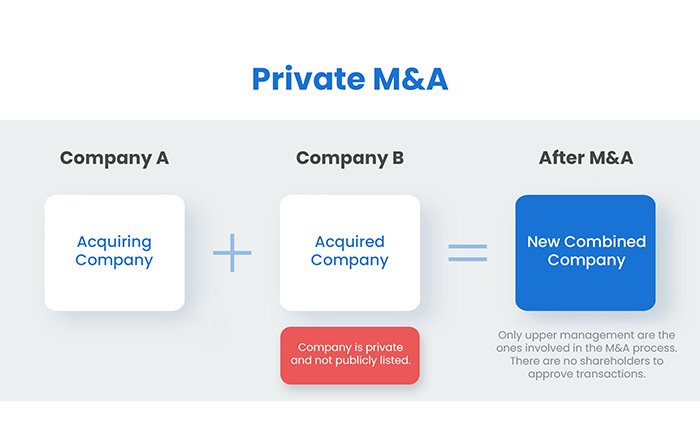

Private M&A Deals

Private M&A deals refer to transactions involving privately owned companies, businesses with fewer than 399 shareholders that are not listed on stock exchanges. Characteristics of private companies include limited public disclosure requirements and less oversight by regulators.

Private companies lack the liquidity of public companies, but they benefit from greater control over decision-making, higher privacy levels, and more protection from hostile bids/takeovers. Transactions between private companies often involve complex negotiations and contracts due to their unique ownership models which differ greatly from those of their publicly traded counterparts.

Key features of private M&A transactions

1. Lower regulatory burden and confidentiality

Private transactions involve fewer regulations than their counterparts, meaning fewer documents are required to establish the validity of a deal and also provide assurance to the parties involved that no laws are broken by entering into the arrangement.

In terms of confidentiality, data disclosing a potential investor or acquiring company can also be managed more efficiently in private M&A transactions. Disclosure in public transactions is tightly regulated with a particular focus on trading stock information related to deals that entice speculation often altering share prices detrimentally.

2. Negotiation and deal structure

Private M&A negotiations and deals tend to be more complex than public transactions due to their smaller size and lack of legal requirements or shareholders. When negotiating private deals, therefore, there is no standardized process.

The parties involved in the deal have greater discretion over important parameters such as terms and conditions. Negotiation timelines are often very fluid–the speed of informal exchanges of redacted documents may significantly vary with teams screening existing companies before deciding on particular deposits/periods for discussions.

Many private deals also include letter-of-intent agreements from both sides setting out binding obligations on all parties prior to finalizing contracts after mutually satisfactory terms are negotiated and agreed upon.

Advantages and challenges of private M&A deals

Private M&A deals have several advantages over public deals including lower regulatory burden and confidentiality. Deals may be structured flexibly allowing for negotiation, contingent payments, and finesse to negotiations that might not be considered with the more formal procedures commonly used when listing a company on an exchange.

Furthermore, due to the lack of transparency (smaller amount of required disclosure) investors can benefit without certain buyers driving up prices via competition. Challenges of private M&A include fewer exit options than public liquidity events like IPOs, additionally hard bargains are being driven by large institutional funds similar to those pushing public transactions.

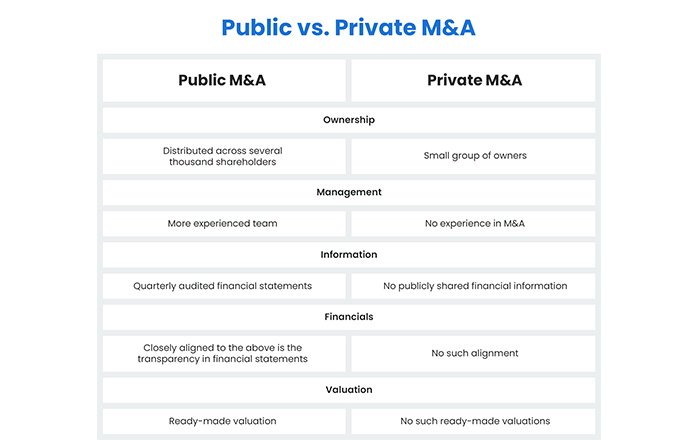

Differences between Public and Private M&A Deals

Legal and regulatory distinctions

The legal and regulatory distinctions between public and private M&A deals are substantial: for a public M&A transaction, various regulations will typically apply requiring disclosure of certain confidential information from the companies involved.

Moreover, shareholders’ consent is required before the deal can finally be completed; shares also have to be listed on some stock exchange in order to permit trading operations.

Conversely, when dealing with private or smaller firms many of these obligations do not always occur – allowing for less scrutiny and greater flexibility during negotiations within employed resources.

Deal processes and timelines

The processes and timelines for public and private M&A deals are typically quite different. Public deals tend to have more extensive legal, accounting, and regulatory processes that need to be accounted for due to the announcement requirements associated with a publicly-traded company.

The bidding process in a public transaction is usually composed of an open auction announced through SEC filings with investor news releases following each bid received until the highest bidder succeeds.

Private transactions have shorter deal timetables less legally stringent negotiation treads with fewer bidders involved in meetings that generally can count on confidentiality from both sides making them easier to keep control discreetly closed without explicitly committing information or opportunities disclosures protecting any reputation damages or leakage of the company might face.

Access to information and due diligence

Access to information and due diligence varies significantly between public and private M&A deals.

Through the material disclosures required of public companies, investors have access to various types of company information which they can use for their due diligence. Private companies must manage disclosure far more carefully as confidential information may be limited in nature by contractual agreements.

Additionally, activities such as earning calls only occur periodically for private companies, though disclosing important information through private entities is not necessary. This limiting factor often impacts buyers planned financial projections during due diligence processes.

Factors Influencing the Choice of Public or Private M&A

Company size and financial resources

Company size and financial resources are significant factors in determining whether a public or private merger and acquisition (M&A) transaction is beneficial. Public companies typically have a larger market capitalization (through readily-traded shares), greater access to liquid assets, staff needed to provide regulatory disclosures and experience with larger markets.

On the other hand, private companies must carefully consider potential liquidity concerns selecting an M&A path due to heightened costs of debt financing as well as restrictions imposed by government agencies engaging in transactions involving more international investors.

Both approaches can be utilized based on overall company strategy but organizations considering an M&A should understand how their particular size and finances will influence deal outcomes before firmly committing to either structure.

Strategic goals and growth objectives

In addition to size and resources, strategic goals and growth objectives are key factors integral in determining whether an M&A deal should be carried out through the public market or as a privately negotiated transaction.

Companies should consider their timeline for achieving synergy potentials, cashing out or exiting their investments, as well as their long-term strategic direction when selecting an appropriate approach.

They can choose either route based on how best it meets their goals with respect to the distribution of proceeds, recognition of appreciation gains, and minimizing deviation from core businesses.

Market conditions and investor sentiment

When considering a public or private M&A transaction, investors and companies must carefully assess factors such as market conditions and investor sentiment. Generally speaking, if the broader market is sputtering and investors are hesitant to pour money into larger transactions due to fear of losses, then companies may opt for an all-cash private deal.

On the other hand, if stock prices are trending upward and there’s an increased appetite for deals in the M&A space, they might prefer taking a public route that would allow them additional clout through enhanced availability of capital.

Reality being what it is though, specific circumstances can change overnight – leaving firms with robust options that may include both pathways depending on liquidity appropriateness and fundamentals at play.

Conclusion

Understanding the differences between public and private M&A transactions is critical for any involved in the acquiring or selling process.

Public deals are subject to heavy regulation and involve shareholder approval. Private deals have fewer regulations, and offer more control and secrecy when negotiating terms, but a premium may not be achieved if the shareholders of an acquired private company differ on price expectations.

The approach chosen for each deal should be aligned with an individual company’s capabilities, budget resources, and long term goals-which will enhance negotiating position and outcomes significantly. Factors such as market conditions, and investor sentiment along with adequate due diligence also influence decision-making in mergers & acquisition fulfillment.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.