Management Buyouts (MBOs): Understanding the Process

Management Buyouts (MBOs) are an integral part of the business world and have become increasingly popular over the last few decades for numerous reasons. An MBO is a type of corporate transaction where a company’s existing management team purchases all or majority shareholding in the same company either with external investors or financing from third-party lenders.

This comprehensive overview aims to provide an understanding of this process from different angles – including key players involved, advantages and disadvantages, strategies for undertaking an MBO, preparation activities, as well as funding options available.

Ultimately this article will equip readers with necessary knowledge needed to start exploring how they can leverage these strategies effectively within their own businesses.

Contents

How Management Buyouts Work

Key players involved in an MBO

When undertaking a management buyout (MBO), there are a number of distinct key players that need to be in place. At the crux of every MBO is management, who some refer to as ‘vendors’ because they are choosing to sell their services and commitment in exchange for equity or some other form of compensation.

In tandem, an external financial investor is often necessary and typically negotiates terms before putting up cash. Also involved may be banks, advisors such as lawyers or accountants depending on structure chosen and regulators overseeing all parties involved in any issues that arise throughout the process.

Additionally, a business team needs to be formed including individuals with experience in both private-equity investing along with intimate operational knowledge concerning the company of interest.

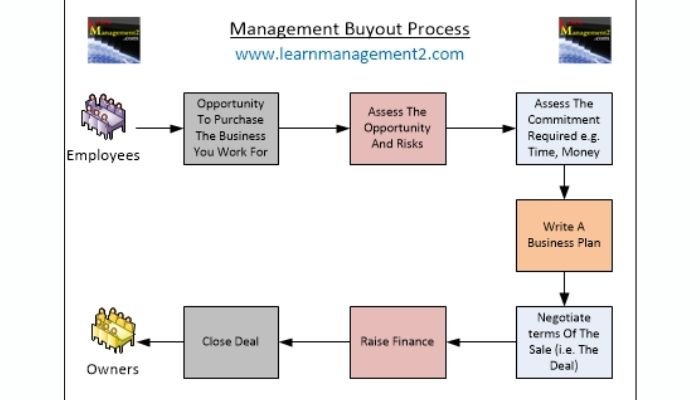

Step-by-step process of a Management Buyout

The process of a Management Buyout (MBO) is a unique transaction that generally involves both several key players and several cognizant steps.

In order to successfully implement an MBO, a core group of owners, or current shareholders such as board directors and employees, look to identify interested investors in order to acquire funds needed for the buyout.

The investors bring their capital in exchange for an equity stake inside the company they are investing in. Then they together agree upon all terms set out in commercial contracts including task segregation between them and the current management staff like rights of workers or decisions on investment-related solutions among other petty details.

Afterward, such agreements result in corporate form changes if possible with respect given within legal parameters allowing the participants to restructure financial contracts, reconciliation relations, and overall new perceptions meant to nurture further the pivotal objectives of the go buy-out.

Advantages of Management Buyouts

Empowering existing management

One of the greatest advantages of Management Buyouts is that they empower existing management.

Executives who have profound knowledge and understanding of their companies manage operations rather than external investors or boards of directors, so practices stay the same to continuously improve customer service and quality assurance levels.

Meanwhile, decision-making authority remains within company boundaries as officials no longer need to inevitably defer to outside stakeholders that may have conflicts of interest for certain initiatives.

Ultimately this allows for a stronger sense of continuity in leadership while portraying an image of stability and strength when transitioning ownership arrangements through an MBO.

Retaining company culture and values

One of the greatest advantages that a Management Buyout (MBO) provides is to help retain company culture and values, specifically by empowering existing management.

An MBO grants control to those with familiarity with an organization’s operations, its objectives and its internal commitment to excellence -characteristics most likely embodied as part of a thriving culture within an enterprise.

Employing current personnel serves well in upholding the institution’s keenest remembered visions while also helping it avoid potential chaos of turnover from attempted reorganization changes introduced from outsiders.

While uncertainties are sure to arise from change when necessary, entrusting those who know an existing framework best via managerial buyouts leverages greater security among stakeholders.

Streamlined decision-making process

Management buyouts offer the potential for a streamlined decision-making process. An MBO presents company leadership and key stakeholders with an opportunity to address multiple matters throughout all business units more rapidly, allowing projects to move through efficiently and avoid costly delays.

With decision-makers focused on aligning financial interests by providing accelerated returns for investors, financial arrangements are quickly managed.

Flatter organizational structures lean towards consensus-decision experiences without the frustration of waiting on senior employees in some instances offering opportunities for greater efficiency spurning needed change such as quicker iterations newer products or more cost effective production environments.

Management buyouts (MBOs) can serve to align the interests of both management and shareholders. Generally, management can act as an agent on behalf of shareholders to ensure their assets are being optimally managed.

This is done by allowing the managers to personally invest in non-voting securities but take part in distribution opportunities from dividends or proceeds from selling a portion of shares when the time is right.

Additionally, through this alignment, there will be better transparency and communication between managers regarding their reasons for cutting costs or making key decisions that will affect company value over time.

Modern MBOs reflect an increasing trend towards ownership for senior managers whose well-aligned interests bring incentives and more commitment during operation decisions due to higher personal investment risk tolerance levels and shareholder valuations.

Disadvantages of Management Buyouts

Financial risks and burdens on management

Management buyouts (MBOs) are acquisitions of a company or division by existing managers. While MBOs offer the potential for many advantages, they also come with risks and burdens on management. These include financial risks such as an inability to secure funding or unstable market conditions.

In addition, raising capital can be difficult if the offering involves hefty leverage ratios that could lead to higher debt costs. Furthermore, sensitive cash flow does not guarantee enough net income from operating activities to make loan payments.

Moreover, taking on too much debt can limit organizational flexibility, making it difficult to respond quickly to changing demand in markets – leading again to financial downfall.

To ensure success in pursuing an MBO will need expertise beyond management’s competence–accounting, finance, taxation and legal – requiring substantial management time get external support.

Potential conflicts of interest

Potential conflicts of interest arise when ownership and management share the same fiduciary duty to driving profits for the company. In matters such as incentive structures, shareholders can have competing interests with management while they also remain heavily vested in corporate decisions at the possibility of personal gains.

Therefore keeping these mutually beneficial incentives balanced between investors’ needs and management goals is vital but difficult to maintain.

Additionally, transparency issues pose a risk that potential rules or regulations based on stringent laws may be circumvented thus compromising business integrity during buyouts related not only to internal parties but from all layers internally and externally during commingling funds or resources for the MBO process.

Thus with appropriate disclosure and regulations, these matters can still move the process forward while protecting stakeholders’ interests.

Limited access to external expertise and resources

A Management Buyout (MBO) can have numerous advantages for companies, but there are also possible drawbacks to be aware of. For example, MBOs typically operate with limited access to external expertise and resources.

This means that the existing management team often runs the show without consulting advisers or vendors who may have helpful and valuable perspectives. A smaller budget for finances can reduce opportunities for company growth as well as cut back on executive roles that may be critical functionally.

There is also no employee diversification harnessing collective knowledge from both internal experts and resource professionals outside the leadership team.

Valuation challenges and negotiation complexities

Valuation challenges and negotiation complexities form a major obstacle for management teams looking to undertake an MBO.

Challenging conditions may arise during the valuation process due to a breakdown in communication between different financial stakeholders, difficulty identifying data related to intangibles or lack of clarity on certain operational issues.

Negotiations can be further complicated due to potential approval processes by shareholders that involve multiple parties with competing interests in terms of cash flow and return expectations.

Furthermore, not having external experts may create scope for advisors with hidden agendas towards a particular outcome leading to going into negotiations. Consequently, valuations and transections could depart significantly resulting in disagreeable terms of trade seeing one party unfairly benefit at the expense of another’s loss.

Undertaking a Management Buyout

Identifying suitable companies for an MBO

Identifying suitable companies for an MBO starts with gauging their profitability, competitive advantages and level of management experience. Going into a detailed review of the company’s financial statements helps in understanding the performance levels achieved by the firm as well as its market value.

Companies that are stable enough and show good potential for growth make them more suited to a Management Buyout. It is also important to evaluate risks associated with acquiring equity control since due diligence on other shareholders involved is essential.

Truly understanding key products, customer base, human capital, supplier and competitor dynamics transparently reveals if the acquisition is viable or not.

Evaluating the feasibility and readiness for an MBO

When undertaking a Management Buyout, it is important to first evaluate whether the MBO project has viable long-term prospects and that all its key sources of capital (equity and debt) can be delivered with relatively low levels of risk.

It is crucial that potential buyers assess the company’s financial performance, culture, strategic objectives, and capability of the existing management in order to make an informed decision on whether or not a practical workable succession plan for ownership transfer exists. If any gaps are identified from the evaluation process or further organizational capability development there should places plans made in place to overcome such issues.

Assembling a competent management team

Assembling an experienced and competent management team is a crucial element of undertaking a successful management buyout. Management must be well-versed in all aspects of the target company such as success models, customer portfolios, strategies, and capabilities to enable them to make informed decisions for the target’s future.

Therefore, it is imperative that members possess specific skills essential to lead and manage the process properly. Additionally, broad knowledge about buying private companies from M&A advisors or consultants should be tapped into in order to minimize risk and obtain maximum potential profits.

Assembling this sort of team also involves selecting suitable financing specialists who can effectively convert requests from investors into acceptable funding structures which would often involve mezzanine finance arrangements or debt capital provision.

Preparation for the MBO Process

Developing a comprehensive business plan

Preparation for a Management Buyout is key to its success. One of the most important parts of this preparation is the creation of a comprehensive business plan. The business plan should spell out in detail all management plans including strategy, policies and procedures, objectives, corporate governance structure, human resources plans and processes, financial goals and information along with any other aspects appertaining to executing an effective MBO.

A thorough analysis of revenue sources and capital expenses must take place beforehand, in order to predict and stay ahead of potential pitfalls. Further approvals should be sought from boards or advisory committees as needed depending upon the jurisdictions involved before setting everything into motion. Such efforts ensure that no foreseeable obstacle threatens to derail what offers a great opportunity for organizational success.

Conducting due diligence on the target company

Conducting due diligence on the target company is an essential element of the preparation stage for undertaking a Management Buyout (MBO). This includes performing detailed research into the company’s operations to identify any potential legal, financial, and reputational risks.

Specifically, this includes investigating the firm’s financial accounts and performances records over time; examining relevant contracts and agreements; assessing tax liabilities; understanding customer relationships; scrutinizing capital structure and other unique elements related to the business; as well as anticipating economic disturbances which may have an effect on revenues or costs. Large gaps in knowledge can derail successful MBOs completely.

Before engaging in the MBO process, management must ensure that they have adequate support and backing from both shareholders and stakeholders.

Appropriate collaboration between the current owners of a target company, related parties such as banks and lenders, third-party advisers, and potential external investors in an MBO offer – should be arranged as part of the preparation for the MBO.

Communication with shareholders is essential to gain approval for an MBO proposal. The recapitalization plan needs to be clearly explained along with the rationale behind it such that informed decisions are made by all involved parties.

On top of this, stakeholder considerations should also be taken into account including their interests, responsibilities, and legal obligations amongst other things when navigating through complexities associated with Management Buyouts.

How Management Buyouts are Funded

Equity contributions from management and external investors

Management buyouts are largely funded through equity contributions by management and limited external investors. For example, a large management team could take in up to 80-100% equity in the company.

It’s also possible that former owners of a business may also contribute data equity payments in lieu of their ownership stake.

Furthermore, an external investor such as a venture capital firm or private investor might invest alongside the existing managers with an equity offer into the new venture.

Finally, debt financing options include loans from banks, private lenders and other sources so that extra cash can be used for needed investments during the MBO (management buyout) process.

Debt financing options

Management buyouts (MBOs) can be funded through the contributions of both external investors and existing management.

One popular way that MBOs are financed is through debt financing options, such as bank loans or revolving lines of credit. This form of funding is typically secured by collateral and carries an interest rate, but offers the advantages of addressing any cash shortfall gaps quickly as well a flexibility with repayment terms.

Another type of loan to consider is mezzanine financing which generally provides either equity or convertible debt; however, higher-risk organizations usually opt for this method due to the uncertain payout outcomes. It’s paramount to ensure there’s a suitable capital structure in place to properly carry out such investment strategies.

Structuring the financial arrangements

Structuring the financial arrangements is an important part of funding a Management Buyout (MBO). Both equity contributions from management and external investors as well as debt financing options need to be taken into consideration in order to cover the purchase cost for the company.

Factors such as level of risk, potential return of investments, payment schedule, term lengths, and tax considerations among others will need to be negotiated between both parties in designing and finalizing the financial structure. Ultimately, it is critical that all stakeholders involved have clarity over their respective commitments and liabilities prior to signing off on the MBO agreement.

Conclusion

Management buyouts are a major transaction in the business world that provides an opportunity for existing management to gain control of their organization and maximize its potential.

Although the process can be difficult, time-consuming, and full of legal technicalities, MBOs offer distinct advantages such as retaining company culture and values, reducing the turnaround timeframe of decisions made by boards and upper executive management teams, plus providing mutual alignment between shareholders’ interests and continue shareholder value passed down from previous owners.

With thorough preparation including due diligence on the target company plus financial arrangements involving equity contributions from investors and debt financing options MBOs are viable approaches for successful corporate transitions.

Ryan Nead is a Managing Director of InvestNet, LLC and it’s affiliate site Acquisition.net. Ryan provides strategic insight to the team and works together with both business buyers and sellers to work toward amicable deal outcomes. Ryan resides in Texas with his wife and three children.